On reviewing the Debt/Equity (ttm) ratio of Countrywide, I was astonished to find that it was 7.934, which means that the debt is 7.934 times the company's entire equity or book value. It is said that the company is also doing a share repurchase with $2.6 billion buy back. Yet there has been no evidence of such buy backs on my research yet. Worse yet, the buy backs are not being done with the total cash that the company has but instead through further debt. Does this make sense to anyone? Also, this buy back is being done in "off balance sheet" fashion which means that it is not recognized as a liability in CFC's balance sheet. It is yet another deceitful efforts by CFC to elevate the share prices of the stock. Generally, you want to see a strong company with manageable debt and strong cash balance doing the buy backs because the insiders feel that the current stock price represents a strong value and is undervalued by the markets. But when a company takes on more debt from its astronomical debt levels to play the wallstreet game of "buy backs" to encourage retail investors to buy their stocks, we have to be a little bit skepticle. When you add the alarming rate at which Samboro and Mozilo and other insiders are selling this stock, you have to question whether the insiders have any faith in this company at all.

The total debt for CFC is $113.60 billion dollars. It is not clear if this represents the additional $2.6 billion that the company took on to buy back shares. We will never know because of the off balance nature of recognizing this debt to buy back shares. Something tells me that it isn't reflected.

The total cash that the company has is $52.54 billion dollars. I wonder how much of this cash will be depleted to meet margin requirements as their subprime loans become delinquent? Additionally, as the share prices falter and the insiders continue to sell their stocks, how much of this cash is needed for legal defense and settlements? This also does not take into account of slowing revenues and squeeze on gross margins as tighter lending requirements and decreased demand will have on the company's cash levels and subsequent ability to meet the short term liabilities?

The misleading price to earnings value of 8.13 and price to book value of 1.45 is allowing some to believe that this company is at great valuations right now. But this is due to recent cut in share prices and does not reflect the health of this company. Additionally, the book value per share of this company is currently $24.47 and declining. But given the off balance nature of the way this company recognizes assets and liabilities what truly constitutes the "honest" book value?

None the less, given the recent tribulations of this company, I can expect this company to trade at or below book value in the near future. As soon as the support is broken and further economic news show that in fact housing woes are not relegated to the subprime only I would expect to see this contract further.

The last question is that the company has been paying out dividends at 1.7%. But usually, companies that pay dividends have rising cash levels and slowing growth. I would say that CFC's growth has halted and declining rapidly as are its cash levels. They can only keep up the charade for so long before the inevitable day of reckoning comes.

Yes, the pain will continue. It is just that the company thus far has been good at hiding the truth.

Saturday, March 17, 2007

Main Stream Media Bias as Yellow Journalism and reinvention of Muckrakers

I know I wrote about this "bias" and lack of objectivity in the main stream media few weeks back.

As Herb Greenberg would say, "the drumbeat continues..."

Today's headline on marketwatch.com reads: "Stocks seen posting modest rises next week: Edgy investors to watch Fed meeting, housing data and earnings". This media double speak has me troubled because it continues to give readers optimisim. In a sense, when things look bleak, I guess everyone needs some infusion of hope. But when it comes to dealing with personal finance and wealth accumulation, it would be more helpful if the main stream media and all those that comprise the financial market community were brutally honest about the current market situation. Going back to the marketwatch.com's double speak, it would be easy to get that the writers are confident about the markets recovering next week. Read a bit further even within the headlines and you will see that the word "edgy" investors await Fed meeting, housing data and earnings. Edgy people are generally waiting for something bad to possibly happen. Instead, wouldn't it be great if the headlines instead read "Investors wait anxiously for economic data to see if recent weakness in the stock markets will continue". Isn't that title more telling of the truth? That our markets are in fact in a down trend and that economic data is being looked at to see if further weakness will continue?

Having said that, why is it such a problem with the main stream media with objectivity? When you look at the reportings from the war on Iraq to the current market weakness, it is very difficult to get the objective "jist" of what is going on. It further complicates things because "news" only sells on sensationalism. I see our country's journalistic integrity on par with yellow journalism, and for that matter, the world journalism is also like that. The "Muck-Rakers" were coined by Theodore Roosevelt to describe those who sought to expose injustices and criminal activities during the early 1900's. A muckraker is an American English term for one who investigates and exposes issues of corruption that violate widely held values, such as political corruption, corporate crime, child labor, conditions in slums and prisons, unsanitary conditions in food processing plants (such as meat), fraudulent claims by manufacturers of patent medicines, labor racketeering, and similar topics. In British English however the term is applied to sensationalist scandal-mongering journalist, not driven by any social principles.

The term muckraker is most usually associated in America with a group of American investigative reporters, novelists and critics in the Progressive Era from the 1890s to the 1920s. It also applies to post 1960 journalists who follow in the tradition of those from that period. Muckrakers have most often sought, in the past, to serve the public interest by uncovering crime, corruption, waste, fraud and abuse in both the public and private sectors. In the early 1900s, muckrakers shed light on such issues by writing books and articles for popular magazines and newspapers such as Cosmopolitan, The Independent, Collier's Weekly and McClure's. Some of the most famous of the early muckrakers are Ida Tarbell, Lincoln Steffens, and Ray Stannard Baker.

An example of a contemporary muckraker work is Ralph Nader's Unsafe at Any Speed (1965) which led to reforms in automotive manufacturing in the United States. Nader's publication led to a stop in the production of the Chevrolet Corvair, one of the first rear-engine American cars. The discontinuation of the Corvair was controversial because many believed the innovative style could have been altered for safety and could have spurred the American automobile industry. The rise of muckraking in the late 19th and early 20th centuries corresponded with the advent of Progressivism yet, while temporally correlated, the two are not intrinsically linked.

Thus efforts of many including Herb Greenberg and many anonymous bloggers whose sole purpose is to expose the corruption, disingenuity, and other unsrupulous practices of the US finanial markets tries to bridge that gap between "yellow" truth and "muckraker" truth. The point in my rantings about the lack of objectivity and truth in the main stream media can be seen with the above example of Ralph Nader's expose on Chevrolet Corvair and eventual rise of safety in American automobile industry. It was widely believed in the 1960' before the muckraker Nader exposed the truth that in fact the American automobile industry was acting in the best interest of the public safety and not in the interest of corporate profit. I am sure that the main stream media was clueless and misled the general public.

In the same way, our financial industry, while it has come a long way in terms of fairness, is still wrought with corruption, deceit, and greed. One needs to only consider just the past 10 years with the Enron, Tyco, Lucent, Cendant, and many other publicly traded companies that misled the investors in the interest of corporate greed. In most of these cases, judgements and indictments did not come after the main share holders were "screwed" out of their money and sometimes their life savings. Yet, the main stream financial media including CNBC, Bloomberg, marketwatch.com, and others continue to fail the general populous that it professes to serve by buying into the propaganda of the corporate deceit and in fact then becomes the very instrument of corporate greed.

The current issue with the subprime mortgage crisis is just gaining wide spread exposure from the main stream media. But I am appalled at the junk and deceit that is being propagated through these channels. Just 6 months ago, this issue was hardly even a small print story in many of the major main stream media. It was an after thought. It misled investors to become complacent and not factor in the ramifications of this crisis. Even now, as evidence clearly points to ominous fall out and future consequences, the main stream media still sides in majority of cases with propaganda campaign by the major investment banks, mutual fund companies, the mortgage companies, and government officials (Fed Chief and Treasury Secretary- who by the way was the head of Goldman Sachs prior to this job). So it now graces head lines of every major main stream media outlet. Yet objectivity is far less evident as it was 6 months ago.

Subprime mortgage fall out has far more integration to the economy than the main stream media and establishment will lead us to believe. Take the next target in question, which is the prime mortgage loans and companies that do business in this sector. Many of the prime mortgages were originated with ALT-A loans which hides behind the word "prime" but beneath that muck, more ominous picture exists. ALT-A option ARMS were given to good credit applicants to be able to "extend" their means and buy the house or properties that they otherwise couldn't afford. I see major fall out from this segment of the mortgage as rising inflation will force the FED to raise interest rates not lower them in the future. Sadly, I believe that the damage has been done and we are waiting for the next shoe to drop and the sad agonizing reality to be felt when it is too late for anyone to do anything about the situation. The prime mortgage being insulated from the subprime mortgage fallout is a facade. It has not yet reached the level of sensationalism for the mainstream media to take notice and "spin" it. In America, he who controls the money, controls the information. The domino effect is clear, and I won't go into much depth here as it is beyond the scope of this blog, but clearly it will affect negatively economic growth, consumer spending, and inflation.

Take for example, the favorable treatment of Countrywide (I know it is getting old) by the media and financial establishments. Many pundits see this outfit surviving the subprime fallout and in some cases thriving in this business. There are 9 analysts covering this company and only one analyst has a negative rating. How can this be? One needs to only consider that analysts are generally wrong during market extremes. Many analysts will have a favorable rating on stocks at market tops and negative ratings on stocks at the market bottoms. I consider this current market to be the inflection point of market top. Historically that is true and one needs to only consider 2000 to 2001 market melt down and the ratings on such names as Broadwing, Ciena, JDSU, Nortel, Global Crossing, and many other high fliers. On the painful death march down in equity prices, the mainstream media and its experts urged retail investors to buy due to favorable valuations while the corporate insiders sold. I believe that is what is going on at Countrywide Financial (CFC). They have launched a major campaign to obtain damage control via CNBC interviews, news paper articles, to mold retail investor's confidence. They also have the financial institutions on their side as they continue to assert that CFC is a buy at these low levels, and that 6 to 12 months out, these stock prices for CFC will "seem" like bargains. I beg to differ on that as the retail investors will again get screwed. Ominous evidence is there. There has been increased insider selling even as the company's prospects are declining. A clear affirmation of their "insider knowledge" while channeling a contrary message to retail investors. When the dust settles we will know only then, if any criminal activities were present. I think so.

So as I part on this pontification today. Please be careful. Please consider only objective facts. Leave out emotions and do not heed the market pundits. For those who closely follow Jim Cramer on CNBC or on thestreet.com, please know this. Cramer has gotten his readers out at the market bottoms and urged his readers to buy on the way down from the 2001 market debacle. If you don't believe me, just Google or read the three months archive of Cramer's recommendations. Thank you.

As Herb Greenberg would say, "the drumbeat continues..."

Today's headline on marketwatch.com reads: "Stocks seen posting modest rises next week: Edgy investors to watch Fed meeting, housing data and earnings". This media double speak has me troubled because it continues to give readers optimisim. In a sense, when things look bleak, I guess everyone needs some infusion of hope. But when it comes to dealing with personal finance and wealth accumulation, it would be more helpful if the main stream media and all those that comprise the financial market community were brutally honest about the current market situation. Going back to the marketwatch.com's double speak, it would be easy to get that the writers are confident about the markets recovering next week. Read a bit further even within the headlines and you will see that the word "edgy" investors await Fed meeting, housing data and earnings. Edgy people are generally waiting for something bad to possibly happen. Instead, wouldn't it be great if the headlines instead read "Investors wait anxiously for economic data to see if recent weakness in the stock markets will continue". Isn't that title more telling of the truth? That our markets are in fact in a down trend and that economic data is being looked at to see if further weakness will continue?

Having said that, why is it such a problem with the main stream media with objectivity? When you look at the reportings from the war on Iraq to the current market weakness, it is very difficult to get the objective "jist" of what is going on. It further complicates things because "news" only sells on sensationalism. I see our country's journalistic integrity on par with yellow journalism, and for that matter, the world journalism is also like that. The "Muck-Rakers" were coined by Theodore Roosevelt to describe those who sought to expose injustices and criminal activities during the early 1900's. A muckraker is an American English term for one who investigates and exposes issues of corruption that violate widely held values, such as political corruption, corporate crime, child labor, conditions in slums and prisons, unsanitary conditions in food processing plants (such as meat), fraudulent claims by manufacturers of patent medicines, labor racketeering, and similar topics. In British English however the term is applied to sensationalist scandal-mongering journalist, not driven by any social principles.

The term muckraker is most usually associated in America with a group of American investigative reporters, novelists and critics in the Progressive Era from the 1890s to the 1920s. It also applies to post 1960 journalists who follow in the tradition of those from that period. Muckrakers have most often sought, in the past, to serve the public interest by uncovering crime, corruption, waste, fraud and abuse in both the public and private sectors. In the early 1900s, muckrakers shed light on such issues by writing books and articles for popular magazines and newspapers such as Cosmopolitan, The Independent, Collier's Weekly and McClure's. Some of the most famous of the early muckrakers are Ida Tarbell, Lincoln Steffens, and Ray Stannard Baker.

An example of a contemporary muckraker work is Ralph Nader's Unsafe at Any Speed (1965) which led to reforms in automotive manufacturing in the United States. Nader's publication led to a stop in the production of the Chevrolet Corvair, one of the first rear-engine American cars. The discontinuation of the Corvair was controversial because many believed the innovative style could have been altered for safety and could have spurred the American automobile industry. The rise of muckraking in the late 19th and early 20th centuries corresponded with the advent of Progressivism yet, while temporally correlated, the two are not intrinsically linked.

Thus efforts of many including Herb Greenberg and many anonymous bloggers whose sole purpose is to expose the corruption, disingenuity, and other unsrupulous practices of the US finanial markets tries to bridge that gap between "yellow" truth and "muckraker" truth. The point in my rantings about the lack of objectivity and truth in the main stream media can be seen with the above example of Ralph Nader's expose on Chevrolet Corvair and eventual rise of safety in American automobile industry. It was widely believed in the 1960' before the muckraker Nader exposed the truth that in fact the American automobile industry was acting in the best interest of the public safety and not in the interest of corporate profit. I am sure that the main stream media was clueless and misled the general public.

In the same way, our financial industry, while it has come a long way in terms of fairness, is still wrought with corruption, deceit, and greed. One needs to only consider just the past 10 years with the Enron, Tyco, Lucent, Cendant, and many other publicly traded companies that misled the investors in the interest of corporate greed. In most of these cases, judgements and indictments did not come after the main share holders were "screwed" out of their money and sometimes their life savings. Yet, the main stream financial media including CNBC, Bloomberg, marketwatch.com, and others continue to fail the general populous that it professes to serve by buying into the propaganda of the corporate deceit and in fact then becomes the very instrument of corporate greed.

The current issue with the subprime mortgage crisis is just gaining wide spread exposure from the main stream media. But I am appalled at the junk and deceit that is being propagated through these channels. Just 6 months ago, this issue was hardly even a small print story in many of the major main stream media. It was an after thought. It misled investors to become complacent and not factor in the ramifications of this crisis. Even now, as evidence clearly points to ominous fall out and future consequences, the main stream media still sides in majority of cases with propaganda campaign by the major investment banks, mutual fund companies, the mortgage companies, and government officials (Fed Chief and Treasury Secretary- who by the way was the head of Goldman Sachs prior to this job). So it now graces head lines of every major main stream media outlet. Yet objectivity is far less evident as it was 6 months ago.

Subprime mortgage fall out has far more integration to the economy than the main stream media and establishment will lead us to believe. Take the next target in question, which is the prime mortgage loans and companies that do business in this sector. Many of the prime mortgages were originated with ALT-A loans which hides behind the word "prime" but beneath that muck, more ominous picture exists. ALT-A option ARMS were given to good credit applicants to be able to "extend" their means and buy the house or properties that they otherwise couldn't afford. I see major fall out from this segment of the mortgage as rising inflation will force the FED to raise interest rates not lower them in the future. Sadly, I believe that the damage has been done and we are waiting for the next shoe to drop and the sad agonizing reality to be felt when it is too late for anyone to do anything about the situation. The prime mortgage being insulated from the subprime mortgage fallout is a facade. It has not yet reached the level of sensationalism for the mainstream media to take notice and "spin" it. In America, he who controls the money, controls the information. The domino effect is clear, and I won't go into much depth here as it is beyond the scope of this blog, but clearly it will affect negatively economic growth, consumer spending, and inflation.

Take for example, the favorable treatment of Countrywide (I know it is getting old) by the media and financial establishments. Many pundits see this outfit surviving the subprime fallout and in some cases thriving in this business. There are 9 analysts covering this company and only one analyst has a negative rating. How can this be? One needs to only consider that analysts are generally wrong during market extremes. Many analysts will have a favorable rating on stocks at market tops and negative ratings on stocks at the market bottoms. I consider this current market to be the inflection point of market top. Historically that is true and one needs to only consider 2000 to 2001 market melt down and the ratings on such names as Broadwing, Ciena, JDSU, Nortel, Global Crossing, and many other high fliers. On the painful death march down in equity prices, the mainstream media and its experts urged retail investors to buy due to favorable valuations while the corporate insiders sold. I believe that is what is going on at Countrywide Financial (CFC). They have launched a major campaign to obtain damage control via CNBC interviews, news paper articles, to mold retail investor's confidence. They also have the financial institutions on their side as they continue to assert that CFC is a buy at these low levels, and that 6 to 12 months out, these stock prices for CFC will "seem" like bargains. I beg to differ on that as the retail investors will again get screwed. Ominous evidence is there. There has been increased insider selling even as the company's prospects are declining. A clear affirmation of their "insider knowledge" while channeling a contrary message to retail investors. When the dust settles we will know only then, if any criminal activities were present. I think so.

So as I part on this pontification today. Please be careful. Please consider only objective facts. Leave out emotions and do not heed the market pundits. For those who closely follow Jim Cramer on CNBC or on thestreet.com, please know this. Cramer has gotten his readers out at the market bottoms and urged his readers to buy on the way down from the 2001 market debacle. If you don't believe me, just Google or read the three months archive of Cramer's recommendations. Thank you.

Friday, March 16, 2007

More on Countrywide GREED

A recent article on Reuters: http://investing.reuters.co.uk/news/articleinvesting.aspx?type=bankingFinancial&storyID=2007-03-16T170127Z_01_N16254655_RTRIDST_0_SP_PAGE_012-N16254655-OISBN.XML

There is a specific quote from Mozillo when asked about his

$140 million worth stock sales over 14 months, he said he was "running out of time" and needed "balance" in his life. I really feel sorry for you. I wonder what "balance" can be bought in life for $140 million? Probably greed.

More importantly, there has been some speculation regarding possible merger with Bank of America (BAC) and that notion was dispeled by the Chief Excecutive Kenneth Lewis in January 07 saying, "the bank 'unequivocally' plans to expand mortgage business organically.

Also, Robert Lacoursiere of Banc of America is the only analyst with a SELL rating on the stock. He specifically states that ""Countrywide has chosen to pursue increased leverage and origination market share gains to hold up earnings," Lacoursiere wrote on Monday. "It is more susceptible to cyclicality and the associated credit risk in a declining competitive market."

While many analysts are pumping hard for Countrywide, unanimously they have lowered expectations for the company. Since Monday, analysts have lowered their average first-quarter profit forecast to 88 cents per share from 98 cents. Countrywide trades around 8.5 times 2007 earnings, below Washington Mutual's 10.5 times and Wells Fargo's 12.5 times. Don't you love that? Let's upgrade the company while downgrading earnings expectations. These deceptive actions by the analysts will lead a lot of investors down the road of Enron.

I am sorry that this site has been dominated by Countrywide (CFC) lately but this company's actions will shed some light into which direction our economy will be headed as I firmly believe that a mortgage industry shakeup and melt down will prelude the US recession and possibly stagflation.

I am short CFC.

There is a specific quote from Mozillo when asked about his

$140 million worth stock sales over 14 months, he said he was "running out of time" and needed "balance" in his life. I really feel sorry for you. I wonder what "balance" can be bought in life for $140 million? Probably greed.

More importantly, there has been some speculation regarding possible merger with Bank of America (BAC) and that notion was dispeled by the Chief Excecutive Kenneth Lewis in January 07 saying, "the bank 'unequivocally' plans to expand mortgage business organically.

Also, Robert Lacoursiere of Banc of America is the only analyst with a SELL rating on the stock. He specifically states that ""Countrywide has chosen to pursue increased leverage and origination market share gains to hold up earnings," Lacoursiere wrote on Monday. "It is more susceptible to cyclicality and the associated credit risk in a declining competitive market."

While many analysts are pumping hard for Countrywide, unanimously they have lowered expectations for the company. Since Monday, analysts have lowered their average first-quarter profit forecast to 88 cents per share from 98 cents. Countrywide trades around 8.5 times 2007 earnings, below Washington Mutual's 10.5 times and Wells Fargo's 12.5 times. Don't you love that? Let's upgrade the company while downgrading earnings expectations. These deceptive actions by the analysts will lead a lot of investors down the road of Enron.

I am sorry that this site has been dominated by Countrywide (CFC) lately but this company's actions will shed some light into which direction our economy will be headed as I firmly believe that a mortgage industry shakeup and melt down will prelude the US recession and possibly stagflation.

I am short CFC.

Week in Review: Dip Buyers Weakening

This is week #2 at attempted bullish reversal. The bulls appear to be running out of strength and conviction. The longer this bear phase lasts, the more tired the dip buyers will become. Having said that this week saw the Dow ending lower 1.4%, Nasdaq lower 0.6%, and the S&P 500 lost 1.1%. Not the type of action you want to see if you are bullish or believe that this is the bottom of the down trend.

Today, the markets started promising but then began to deteriorate through the mid day and tried to regain some of the losses but ended up down 0.3% for Nasdaq, 0.4% for Dow, 0.4% for S&P 500. Strong start and weak finish is the hall mark of bear market action. Also, even though today was quadruple witching, the high volume associated with this three times a year event is significant based on the context of price action. Thus the rally attempt that started on Wednesday and showed much promise on Thursday, lost all momentum on Friday. Next week promises to be continuation of volatility with the FED meeting that is scheduled to take place on March 21 Wednesday at 2:15 PM EST. On Tuesday March 20, 8:30 AM EST, the housing starts and building permits will be released and should further fan the flames of current issues with subprime mortgage fall out. On Friday March 22 Friday, existing home sales will be reported at 10:00 AM EST with market expectation of 6.35 million from prior 6.46 million.

Traders have become jittery to say the least, especially those who are chasing bottoms. Mondays have not been very kind and a lot of traders are looking for another shoe to drop to precipitate a sell off in the markets. This is the extent of the market deterioration of psychology and it will continue to decline. Historically speaking, down trends whether significant or a blip does not recover in a matter of weeks. So we should have a bit of down side pressure to go.

I watch in amazement in the rapid recovery of Accredited Home Lenders (LEND) the lows of $3.77 on 3/13/2007 an finishing at $10.90 on 3/16/2007. What could possibly be the good news? Certainly, the company has found someone to buy their existing subprime debt at pennies on the dollar to infuse badly needed liquidity into the company to meet margin calls. So what does that prove? Accredited Home Lenders (LEND) is a subprime lender. After meeting their margin calls, can they continue to generate business when they can't originate loans? What purpose does this serve? So they get to survive for another week. Then what? They still have to meet securities filing dead lines and still need waivers of covenants that place restrictions on the company's ability to lend. That seems like a bit too much bullets to dodge. There have been possible buy out rumors circulating around Accredited Home Lenders (LEND) from such respected organizations such as Goldman Sachs (GS). If I had to guess, this may have been a dirty hedge fund scheme to drive up prices while they hedged on a quick options trade that brought up the price from the dead to $10.90. That may explain such a huge put volume on this stock currently as traders now bet that it will sink again.

As for Fremont General Corp (FMT), it was able to obtain a $1 billion credit line to sustain this company on life support. Then what for this company? The same quagmire as Accredited. I do understand that the investment banking community and the economy needs these subprime lenders to stay afloat long enough for them to figure out what the fall outs will be from this debacle. Additionally, many bullish upgrades recently on Accredited Home Lenders (LEND) by FBR, Merril Lynch, and others may be a ploy for the greater equity markets to figure out what to do. What pray tell can be so bullish about these sub prime lenders who are on its last leg? What value can be derived from a business that cannot conduct business even if their credit obligations are met? Who in their right mind would want a loan, if that was possible, from these highly publicized sub prime lenders? All the while, I am getting tired to listening to the spin placed by CNBC and the main stream media.

Then there was Alan Greenspan, who has the knack from appearing out of the retirement and proves that he still can affect the US and global equity markets. That he is, while old as dirt, intelligent, able, and significant. His artful speak about him not seeing the subprime meltdown extending into other financial segments of the economy if and only if the housing markets can appreciate 10% this year. In essence when you read between the lines (somethings never change), Mr. Greenspan effectively concluded that this market is basically headed for the recession. How can housing markets appreciate by 10% this year? Based on what demand? Am I the only one reading his statement this way?

Then there is Counrywide Financial (CFC) who is busy doing major PR efforts to curtail the company's image being linked to subprime lenders who are in trouble. The CEO Angelo Mozillo has appeared on CNBC to strongly defend his company's ability to weather any mortgage related storm, and yet, did a double speak and said that only the FED can save this industry with a interest rate cut. Real strong endorsement if you ask me. All the while, when you dig deeper, the company states that their subprime exposure is only 7% of their entire outstanding loan portfolio yet a recent marketwatch.com article shows that they are in fact #3 in subprime lending based on volume. Additionally, their over exposure to ALT-A Option ARMS are at a staggering 45 to 50%. ALT-A Option ARMS are even more toxic as they drove borrowers with good credits into homes that would soon become unaffordable once interest rates rise. Perhaps this is why Mozillo publically called for the FEDS to cut interest rates now. All the while, the CEO who is the champion of his mighty company has been dumping his stock like it is going out of fashion. Herb Greenberg from marketwatch.com has been on him for over a year for his activities and it raises an eye brow or two when the CEO says one thing about his company but his actions are contrary. Is Enron like ending possible for the American market darling Countrywide? This soap opera gets better and better.

In sum, the drama in the mortgage sector bears (no pun intended) close scrutiny. Despite constant noise that this is a contained event and not likely to affect the entire financial markets, the domino effect is definitely possible. Loss of liquidity and wealth from the housing fall out will directly correlate into further reduction in US economic growth while triggering rising inflationary pressures. I am short but it is okay to stay out of this fray in cash, which I wished I had the courage to do. But please be careful out there and trust no one but yourself.

Today, the markets started promising but then began to deteriorate through the mid day and tried to regain some of the losses but ended up down 0.3% for Nasdaq, 0.4% for Dow, 0.4% for S&P 500. Strong start and weak finish is the hall mark of bear market action. Also, even though today was quadruple witching, the high volume associated with this three times a year event is significant based on the context of price action. Thus the rally attempt that started on Wednesday and showed much promise on Thursday, lost all momentum on Friday. Next week promises to be continuation of volatility with the FED meeting that is scheduled to take place on March 21 Wednesday at 2:15 PM EST. On Tuesday March 20, 8:30 AM EST, the housing starts and building permits will be released and should further fan the flames of current issues with subprime mortgage fall out. On Friday March 22 Friday, existing home sales will be reported at 10:00 AM EST with market expectation of 6.35 million from prior 6.46 million.

Traders have become jittery to say the least, especially those who are chasing bottoms. Mondays have not been very kind and a lot of traders are looking for another shoe to drop to precipitate a sell off in the markets. This is the extent of the market deterioration of psychology and it will continue to decline. Historically speaking, down trends whether significant or a blip does not recover in a matter of weeks. So we should have a bit of down side pressure to go.

I watch in amazement in the rapid recovery of Accredited Home Lenders (LEND) the lows of $3.77 on 3/13/2007 an finishing at $10.90 on 3/16/2007. What could possibly be the good news? Certainly, the company has found someone to buy their existing subprime debt at pennies on the dollar to infuse badly needed liquidity into the company to meet margin calls. So what does that prove? Accredited Home Lenders (LEND) is a subprime lender. After meeting their margin calls, can they continue to generate business when they can't originate loans? What purpose does this serve? So they get to survive for another week. Then what? They still have to meet securities filing dead lines and still need waivers of covenants that place restrictions on the company's ability to lend. That seems like a bit too much bullets to dodge. There have been possible buy out rumors circulating around Accredited Home Lenders (LEND) from such respected organizations such as Goldman Sachs (GS). If I had to guess, this may have been a dirty hedge fund scheme to drive up prices while they hedged on a quick options trade that brought up the price from the dead to $10.90. That may explain such a huge put volume on this stock currently as traders now bet that it will sink again.

As for Fremont General Corp (FMT), it was able to obtain a $1 billion credit line to sustain this company on life support. Then what for this company? The same quagmire as Accredited. I do understand that the investment banking community and the economy needs these subprime lenders to stay afloat long enough for them to figure out what the fall outs will be from this debacle. Additionally, many bullish upgrades recently on Accredited Home Lenders (LEND) by FBR, Merril Lynch, and others may be a ploy for the greater equity markets to figure out what to do. What pray tell can be so bullish about these sub prime lenders who are on its last leg? What value can be derived from a business that cannot conduct business even if their credit obligations are met? Who in their right mind would want a loan, if that was possible, from these highly publicized sub prime lenders? All the while, I am getting tired to listening to the spin placed by CNBC and the main stream media.

Then there was Alan Greenspan, who has the knack from appearing out of the retirement and proves that he still can affect the US and global equity markets. That he is, while old as dirt, intelligent, able, and significant. His artful speak about him not seeing the subprime meltdown extending into other financial segments of the economy if and only if the housing markets can appreciate 10% this year. In essence when you read between the lines (somethings never change), Mr. Greenspan effectively concluded that this market is basically headed for the recession. How can housing markets appreciate by 10% this year? Based on what demand? Am I the only one reading his statement this way?

Then there is Counrywide Financial (CFC) who is busy doing major PR efforts to curtail the company's image being linked to subprime lenders who are in trouble. The CEO Angelo Mozillo has appeared on CNBC to strongly defend his company's ability to weather any mortgage related storm, and yet, did a double speak and said that only the FED can save this industry with a interest rate cut. Real strong endorsement if you ask me. All the while, when you dig deeper, the company states that their subprime exposure is only 7% of their entire outstanding loan portfolio yet a recent marketwatch.com article shows that they are in fact #3 in subprime lending based on volume. Additionally, their over exposure to ALT-A Option ARMS are at a staggering 45 to 50%. ALT-A Option ARMS are even more toxic as they drove borrowers with good credits into homes that would soon become unaffordable once interest rates rise. Perhaps this is why Mozillo publically called for the FEDS to cut interest rates now. All the while, the CEO who is the champion of his mighty company has been dumping his stock like it is going out of fashion. Herb Greenberg from marketwatch.com has been on him for over a year for his activities and it raises an eye brow or two when the CEO says one thing about his company but his actions are contrary. Is Enron like ending possible for the American market darling Countrywide? This soap opera gets better and better.

In sum, the drama in the mortgage sector bears (no pun intended) close scrutiny. Despite constant noise that this is a contained event and not likely to affect the entire financial markets, the domino effect is definitely possible. Loss of liquidity and wealth from the housing fall out will directly correlate into further reduction in US economic growth while triggering rising inflationary pressures. I am short but it is okay to stay out of this fray in cash, which I wished I had the courage to do. But please be careful out there and trust no one but yourself.

Thursday, March 15, 2007

Countrywide as a Prime Lender is a Facade!

Just look at the rankings for subprime lending for Countrywide:

Top subprime mortgage lenders

Rank Lender Location Q4 2006 originations, in billions

1 HSBC Finance (HSBC) Prospect Heights, IL $12.3

2 New Century Financial Irvine, CA $12.2

3 Countrywide Financial Calabasas, CA $10.1

4 WMC Mortgage (GE) Burbank, CA $9.0

5 First Franklin (Merrill Lynch) San Jose, CA $7.8

6 Wells Fargo Home Mortgage San Francisco, CA $7.4

7 Option One (H&R Block) Irvine, CA $6.1

8 Fremont Investment & Loan* Santa Monica, CA $6.0

9 Washington Mutual* Seattle, WA $5.7

10 CitiFinancial (Citigroup)* Baltimore, MD $5.0

It is ranked #3! Just behind New Century Financial. Yet the company keeps stating that they will not be harmed by the subprime market meltdown. All the while the company also has significant exposure to the ALT-A Option ARM package which is more toxic than the subprime loans. Additionally, the insiders, especially the CEO is selling his shares of the stock like something is not right at his own company. He certainly does not practice what he preaches.

Top subprime mortgage lenders

Rank Lender Location Q4 2006 originations, in billions

1 HSBC Finance (HSBC) Prospect Heights, IL $12.3

2 New Century Financial Irvine, CA $12.2

3 Countrywide Financial Calabasas, CA $10.1

4 WMC Mortgage (GE) Burbank, CA $9.0

5 First Franklin (Merrill Lynch) San Jose, CA $7.8

6 Wells Fargo Home Mortgage San Francisco, CA $7.4

7 Option One (H&R Block) Irvine, CA $6.1

8 Fremont Investment & Loan* Santa Monica, CA $6.0

9 Washington Mutual* Seattle, WA $5.7

10 CitiFinancial (Citigroup)* Baltimore, MD $5.0

It is ranked #3! Just behind New Century Financial. Yet the company keeps stating that they will not be harmed by the subprime market meltdown. All the while the company also has significant exposure to the ALT-A Option ARM package which is more toxic than the subprime loans. Additionally, the insiders, especially the CEO is selling his shares of the stock like something is not right at his own company. He certainly does not practice what he preaches.

CPI is Highly Anticipated for Friday's Market

The markets shrugged off the high PPI numbers and focused on comments by Bear Stearns and Morgan Stanley regarding sub prime market place not spilling over into other aspects of the economy. The market also ignored comments by Alan Greenspan who spoke about the dangers of sub prime mortgage industry meltdown. He did not see sub prime melt down affecting the economy but hinted that recession may be a possiblity. I don't know why it is that he keeps popping up out of the dead to infuse a bit of panic in the market. Geez! If you're retired, stay that way! That is the mantra of this market who is good at being manipulated by the big institutional players. The market should continue to ignore the ominous signs and warnings at their own peril.

Now the markets are spinning the issue with CPI being the major catalyst for the market. I don't know but I highly doubt that even CPI will be able to sway this market one way or the other. But certainly, the market does not seem to care about inflation at this point in favor of the recessionary fears. What the markets should really be fearing is the prospect of stagflation. I don't really care what the CPI shows whether it is too high, too low, or just right. The real thing that will move this market is the big "R" or recesion. We are fixated on it. We know it will be coming but we just don't want to believe that it could happen. We as a whole populace do not want the good times to end. Thus we keep ignoring ominous signs in the market place and continue to believe in things like, if only the feds would cut interest rates, everything will be fine. We are delusional.

The propanganda main stream media continues to pump optimism and sadly many investors are being sucked into the false sense of security in this market. I have people again calling for bottoms in this correction only after two weeks of pain. That tells me we are not yet done going down. This market is fundamentally different from many other market corrections. There are many issues with our economic factors that tells me that it is not healthy. Here are my main reasons why I am so down on the market:

1. Housing Bubble has not yet burst.

2. Liquidity crisis of prime and sub prime mortgage fall out.

3. Highly leveraged state of American consumers.

4. Corporate Corruption- see Countrywide CEO Angelo Mozillo's indiscriminate liqudiation of his stocks while assuring investors that all is fine at his company.

5. Unrestrained inflation.

6. Unstable global oil markets.

7. Weakening economy

8. Manipulative spinster main stream media who are spinning their own agenda.

On a separate note, Countrywide CEO Angelo Mozillo is liqudiating his shares in CFC like it is out of fashion. To avoid Ken Lay type of accusation if and when CFC falters, he is disclosing his activity in plain day light. And yet, the analysts, the main stream media, continue to support CFC even as the insiders are liquidating their holdings. How many times do we as investors have to be burned by such blatant and offensive actions of greed by these corporate level insiders before we realize the objective truth that something is quite not right at CFC despite the spin placed by FBR, Morgan Stanley, Bear Stearns, and other influential media pundits? Do we forget that Enron, Worldcom, Lucent, and many others before CFC had high brokerage ratings and was highly recommended while the insiders sold while the retail investors bought? Are we doomed to repeat this mistake again?

CFC has high exposure to option ARMS (ALT-A) mortgage. Even if the CEO states that they are only exposed to 7% of their entire portfolio of loans to subprime section, the fall out will touch even the prime segments of that company. Additionally, the market needs to have CFC, which is the poster child of this sector, to be placed in the best light as possible to continue to prop up the markets. The shoe will continue to drop and how many times do we have to see the "dead cat bounces" before investors wise up and go to cash? I will do my part to continue to short the market in the mean time.

Now the markets are spinning the issue with CPI being the major catalyst for the market. I don't know but I highly doubt that even CPI will be able to sway this market one way or the other. But certainly, the market does not seem to care about inflation at this point in favor of the recessionary fears. What the markets should really be fearing is the prospect of stagflation. I don't really care what the CPI shows whether it is too high, too low, or just right. The real thing that will move this market is the big "R" or recesion. We are fixated on it. We know it will be coming but we just don't want to believe that it could happen. We as a whole populace do not want the good times to end. Thus we keep ignoring ominous signs in the market place and continue to believe in things like, if only the feds would cut interest rates, everything will be fine. We are delusional.

The propanganda main stream media continues to pump optimism and sadly many investors are being sucked into the false sense of security in this market. I have people again calling for bottoms in this correction only after two weeks of pain. That tells me we are not yet done going down. This market is fundamentally different from many other market corrections. There are many issues with our economic factors that tells me that it is not healthy. Here are my main reasons why I am so down on the market:

1. Housing Bubble has not yet burst.

2. Liquidity crisis of prime and sub prime mortgage fall out.

3. Highly leveraged state of American consumers.

4. Corporate Corruption- see Countrywide CEO Angelo Mozillo's indiscriminate liqudiation of his stocks while assuring investors that all is fine at his company.

5. Unrestrained inflation.

6. Unstable global oil markets.

7. Weakening economy

8. Manipulative spinster main stream media who are spinning their own agenda.

On a separate note, Countrywide CEO Angelo Mozillo is liqudiating his shares in CFC like it is out of fashion. To avoid Ken Lay type of accusation if and when CFC falters, he is disclosing his activity in plain day light. And yet, the analysts, the main stream media, continue to support CFC even as the insiders are liquidating their holdings. How many times do we as investors have to be burned by such blatant and offensive actions of greed by these corporate level insiders before we realize the objective truth that something is quite not right at CFC despite the spin placed by FBR, Morgan Stanley, Bear Stearns, and other influential media pundits? Do we forget that Enron, Worldcom, Lucent, and many others before CFC had high brokerage ratings and was highly recommended while the insiders sold while the retail investors bought? Are we doomed to repeat this mistake again?

CFC has high exposure to option ARMS (ALT-A) mortgage. Even if the CEO states that they are only exposed to 7% of their entire portfolio of loans to subprime section, the fall out will touch even the prime segments of that company. Additionally, the market needs to have CFC, which is the poster child of this sector, to be placed in the best light as possible to continue to prop up the markets. The shoe will continue to drop and how many times do we have to see the "dead cat bounces" before investors wise up and go to cash? I will do my part to continue to short the market in the mean time.

PPI Comes in HOT!

PPI today was 1.2% and Core PPI was 0.4%. Inflation is high and you could pretty much forget the FED cutting interest rates any time soon. This news should create some downward force on the markets today. Dow is down -24 as I speak and Nasdaq is down -.5. Oil is edging up,

This should continue to put pressure on the mortgage markets. As I see the premarket trades, Accredited Home Lenders (LEND) is trading up. This is probably due to take over rumors by Goldman Sachs. I do not think that is possible and LEND now should be considered a prime short right now. The best way is to take advantage with PUT options rather than borrowing common shares.

Countrywide Financial should be shorted on any strength such as today. The underbelly of CFC is being exposed and the WSJ and Marketwatch.com is hot on its trails. Excellent posts at Yahoo message boards at least for the time being is a refreshing change from the usual BS that goes on at that site. Keep up the good work guys!

Google and BIDU appears to be good short candidates today. I believe BIDU will retest the 200 EDMA if the market conditions continue to detriorate based on the PPI numbers. The death spiral of the equity markets will continue today.

Good luck trading.

This should continue to put pressure on the mortgage markets. As I see the premarket trades, Accredited Home Lenders (LEND) is trading up. This is probably due to take over rumors by Goldman Sachs. I do not think that is possible and LEND now should be considered a prime short right now. The best way is to take advantage with PUT options rather than borrowing common shares.

Countrywide Financial should be shorted on any strength such as today. The underbelly of CFC is being exposed and the WSJ and Marketwatch.com is hot on its trails. Excellent posts at Yahoo message boards at least for the time being is a refreshing change from the usual BS that goes on at that site. Keep up the good work guys!

Google and BIDU appears to be good short candidates today. I believe BIDU will retest the 200 EDMA if the market conditions continue to detriorate based on the PPI numbers. The death spiral of the equity markets will continue today.

Good luck trading.

Wednesday, March 14, 2007

Great Post on Herb Greenberg's Blog at Marketwatch.com

This is a good post from Dennis Nguyen who brings up parallels of Enron's off balance sheet transactions at CFC. Notably, they are buying their shares back with debt (bonds), which equates to nothing other than propaganda. More and more skeletons are coming out of the closet. In the mean time, Mozillo and his cohorts continue to sell.

Please check it out:

http://blogs.marketwatch.com/greenberg/2007/03/playing_survivo.html

Something just doesn't add up.

Please check it out:

http://blogs.marketwatch.com/greenberg/2007/03/playing_survivo.html

Something just doesn't add up.

Insights into Countrywide Financial

I was wading through google searches today to see what I can dig up in terms of what the mortgage brokers are talking about in regards to CFC and I was a bit astounded to find out that CFC is predatory and mortgage brokers hate working with CFC. Additionally, a lot of the brokers seem to feel that pay option arms (ALT-A) are a scam. Rest assured, this will blow up. That is why Mozillo is selling!

"I got to attend a meeting with Angelo Mozillo (mister countrywide) today, that was entertaining.Yes the mortgage industry sucks and all of us in it are on shaky ground...good time to move into another sector at least until the market turns itself around.It still amazes me that busineses can be so succesful while making such horribly bad decisions...really says something about our society. Also payoption ARM loans are a blatant scam imho. The real estate equivelant to star craft map hax."

That was posted by Catatonic on February 2006 on http://www.notacult.com/forums/showthread.php?t=6899

There are many posts like this occurring all over the internet chat sites, blogs, and mortgage broker forums. The shoe will drop, question is when?

"I got to attend a meeting with Angelo Mozillo (mister countrywide) today, that was entertaining.Yes the mortgage industry sucks and all of us in it are on shaky ground...good time to move into another sector at least until the market turns itself around.It still amazes me that busineses can be so succesful while making such horribly bad decisions...really says something about our society. Also payoption ARM loans are a blatant scam imho. The real estate equivelant to star craft map hax."

That was posted by Catatonic on February 2006 on http://www.notacult.com/forums/showthread.php?t=6899

There are many posts like this occurring all over the internet chat sites, blogs, and mortgage broker forums. The shoe will drop, question is when?

Do Not Buy This Bounce!

Tomorrow 3/16/2007, the markets should try to extend their gains today, emboldened by the dramatic turn around on higher volume today. This would count as day one of the attempted rally after the sell off on Tuesday. Many will probably proclaim that the bottom of this market has been achieved. Notably, if you have access to thestreet.com, please do not heed Cramer's advice. He has called too many bottoms recently and all of them have gotten his readers into trouble.

Asian markets are rebounding in sympathy to our markets. That should start a chain reaction in our markets tomorrow. As I have always said, "sell the strength and buy the weakness" in this market. Volatility and trend is your friend. Nothing other than shorting to the downside for the long term (more than 3 months) will work. But staying in cash and protecting your capital is probably the best idea right now. There are some exciting shorting opportunities available especially if the market bounces again tomorrow. But please keep your eyes on the price volume action. The market rebound today was impressive but it is nothing to write home about in terms of reversing the down trend. Right now, we will continue to have fall outs from subprime mortgage markets but we should also keep our eyes and ears peeled for issues associated with prime mortgage markets as well, especially with the (ALT-A Mortgages). Good short candidates are: CME, AAPL, GOOG, BIDU, CME, GS, LEH, MS, RATE.

PPI numbers will be released at 8:30AM EST. Market expects PPI to be 0.5% and core PPI to be 0.2%. Producers Price Index (PPI) is not that important but the markets will focus on it because everyone is trying to hold on to some bastian of hope. Longs and shorts alike will spin it anyother way. Unfortunately any effects from PPI report will be short lived and may cause short term volatility but nothing more. This is because PPI is a lagging indicator and is affected by many biases and adjustments. If PPI comes in higher than forecast, it will stir inflation worries again but the markets may actually applaud this in the short term due to easing of "recession" worries tied with current housing market debacle. If PPI comes in lower than forecast, it will stir recession worries and the markets may sell off on this news even though interest rate cut hopes will rise. That would be my guess, but it is only that.

I am looking to add to BIDU or CFC puts based on which stock is rising. Good luck everyone. Investigate everything and trust no one.

Asian markets are rebounding in sympathy to our markets. That should start a chain reaction in our markets tomorrow. As I have always said, "sell the strength and buy the weakness" in this market. Volatility and trend is your friend. Nothing other than shorting to the downside for the long term (more than 3 months) will work. But staying in cash and protecting your capital is probably the best idea right now. There are some exciting shorting opportunities available especially if the market bounces again tomorrow. But please keep your eyes on the price volume action. The market rebound today was impressive but it is nothing to write home about in terms of reversing the down trend. Right now, we will continue to have fall outs from subprime mortgage markets but we should also keep our eyes and ears peeled for issues associated with prime mortgage markets as well, especially with the (ALT-A Mortgages). Good short candidates are: CME, AAPL, GOOG, BIDU, CME, GS, LEH, MS, RATE.

PPI numbers will be released at 8:30AM EST. Market expects PPI to be 0.5% and core PPI to be 0.2%. Producers Price Index (PPI) is not that important but the markets will focus on it because everyone is trying to hold on to some bastian of hope. Longs and shorts alike will spin it anyother way. Unfortunately any effects from PPI report will be short lived and may cause short term volatility but nothing more. This is because PPI is a lagging indicator and is affected by many biases and adjustments. If PPI comes in higher than forecast, it will stir inflation worries again but the markets may actually applaud this in the short term due to easing of "recession" worries tied with current housing market debacle. If PPI comes in lower than forecast, it will stir recession worries and the markets may sell off on this news even though interest rate cut hopes will rise. That would be my guess, but it is only that.

I am looking to add to BIDU or CFC puts based on which stock is rising. Good luck everyone. Investigate everything and trust no one.

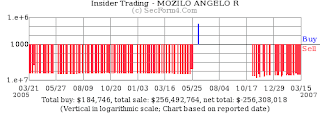

Interesting graphic Representation of Mazillo CFC Chairman's Selling Rate

I just found this excellent graphics to show the intensity of Mazillo's selling activity lately.

Notice that from 12/29/06 and on, the lines are more intense representing intensity of selling. Something is not all right at CFC as I mentioned before. You might also take a look at the following blog site by the La Jolla Guy:

Wall Street Journal Finally Comes Around to Insider Selling at Countrywide

Finally! This is from Scott Patterson from Wall Street Journal Online today.

Some Countrywide Insiders, CEO Sell Stock as Shares Fall

Since hitting its highest closing level in early February, shares of Countrywide Financial, the largest U.S. mortgage lender, have dropped 24%.

The Calabasas, Calif., company isn't overly exposed to troubled subprime mortgages, which make up 7% of its loan originations. It has played aggressively in other exotic mortgages, like option adjustable-rate mortgages, which give borrowers a variety of payment choices and interest rates that reset. At year-end 2006, Countrywide had about $33 billion in option ARMs on its books, about 42% of its overall loan portfolio, according to Standard & Poor's.

Corporate insiders seem to have gotten jittery about something.

Total insider sales at Countrywide for the first quarter are $90.1 million so far, the highest amount of quarterly selling during the past five years, according to Thomson Financial.

Since Feb. 5, as the stock has fallen, Chief Executive Angelo Mozilo has sold 882,000 shares of the company for a total of $34.8 million. Mr. Mozilo owned 11.5 million shares and exercisable stock options of Countrywide in all as of April 5, 2006, according to regulatory filings.

While it's normal to see large insider sales when a stock is on the rise, sales during declines are more unusual and potentially worrisome. A company spokeswoman declined to comment.

--Scott Patterson

Send comments to justin.lahart@wsj.com and scott.patterson@wsj.com

Some Countrywide Insiders, CEO Sell Stock as Shares Fall

Since hitting its highest closing level in early February, shares of Countrywide Financial, the largest U.S. mortgage lender, have dropped 24%.

The Calabasas, Calif., company isn't overly exposed to troubled subprime mortgages, which make up 7% of its loan originations. It has played aggressively in other exotic mortgages, like option adjustable-rate mortgages, which give borrowers a variety of payment choices and interest rates that reset. At year-end 2006, Countrywide had about $33 billion in option ARMs on its books, about 42% of its overall loan portfolio, according to Standard & Poor's.

Corporate insiders seem to have gotten jittery about something.

Total insider sales at Countrywide for the first quarter are $90.1 million so far, the highest amount of quarterly selling during the past five years, according to Thomson Financial.

Since Feb. 5, as the stock has fallen, Chief Executive Angelo Mozilo has sold 882,000 shares of the company for a total of $34.8 million. Mr. Mozilo owned 11.5 million shares and exercisable stock options of Countrywide in all as of April 5, 2006, according to regulatory filings.

While it's normal to see large insider sales when a stock is on the rise, sales during declines are more unusual and potentially worrisome. A company spokeswoman declined to comment.

--Scott Patterson

Send comments to justin.lahart@wsj.com and scott.patterson@wsj.com

FBR Upgrades Countrywide Financial to Outperform

I was taken aback today by Friedman Billing's upgrade of Countrywide Financial today. I believe this upgrade was agenda driven and has no real substance behind it. Any decent analyst will take into consideration significant macro economic implications behind the mortgage industry. Analysts should consider their fiduciary duty to not only their own company but also for the welfare of the shareholders of the stocks that they recommend. In this instance, I find this to be a gross negligence on the part of Paul Miller who is the analyst who upgraded Countrywide financial today.

The part that I don't understand is that Paul Miller downgraded Countrywide Financial (CFC) on January 30, 2007 from Outperform to Market Perform. Today on March 14, 2007, just over 2 months later, he flip flopped his opinion to Outperfrom from Market Perform. The main reason behind this upgrade is that Paul Miller assumes that Countrywide Financial (CFC) will survive the subprime meltdown and will emerge as the leader in subprime lending business as a result of other "competitors" going out of business. He contends that Countrywide Financial is strong enough to weather this "storm" and emerge stronger as a result of the purge both in the subprime and prime mortgage lending business. Bottom line is that the business at CFC will grow as a result of these recent activities. I will read the research report when it is available as it is not yet published on the FBR site (Friedman Billings Ramsey).

The erroneous contention that subprime business is a viable model has been ignored by the main stream financial media and the industry. The reason for this may not be too far fetched to consider that the financial community has conflict of interest in terms of share holder welfare and obligations to the companies that they follow. This can take the form of owning shares in the company in the hedge funds or mutual funds that they control, having an investment banking relationship with the company, or having non equity stake in the company. I believe that it is this conflict of interest that misleads the vast majority of shareholders in the "retail" segment of the equity market. At this point it is mere speculation and futile attempts at mental exercise to consider all the reasons for the upgrade other than what is purported to be true by FBR.

One consideration many analysts and pundits fail to realize about the subprime meltdown is that it is not insulated. I have harped on this issue over the past few days on my prior blogs. Even a small exposure to the subprime market can have compounding negative ramifications on the company such as Countrywide Financial. In order to originate the subprime loan, the company takes tremendous risks associated with possible loan default. In exchange, the lending company is rewarded with higher application fees, restrictive clauses in the loan agreement against the borrower (such as early termination fees- which can be as high as 20% of the outstanding principal), and higher interest rates. It is the high rate of return on investment that the subprime market focused on. When it was sexy, not less than 8 months ago, many main stream banks such as HSBC sought out these risky loans to increase their bottom line. Once the subprime slime has been exposed and the "hysteria" has spread in the stock market, these loans are no longer the highly sought after investment vehicles that it once was. A leper has better chances currently. This is creating a severe liquidity crisis, because many of these subprime loans are bought by other investors, banks, and hedge funds for their returns. Right now, it is considered to be about attractive as cow dung. Angelo Mozillo publicly stated that mortgage industry will face severe liqudity crisis for this very same reason. Spillover effect of the subprime meltdown is complicated but if it can be simplified, I would state that the demand for the mortgage loans would be directly proportional to the willing and able loan applicants. The purging of the subprime market does not mean subprime applicant cannot qualify for a loan. It means that the industry must have quantifiable accountability for the loans. Additionally, as the industry cracks down on its lending practices, even prime applicants will have problems obtaining the mortgage that they need because the ristrictions and guidlines will become stricter. Additionally, the same prime applicants who financed their houses are over extended in terms of what they can afford and many have resorted to 5/1 ARMS or its derivatives or have bought houses with interest only loans. It is also purported that many subprime loans were made to illegal aliens and foreign nationals. If these contingents, probably small in sheer percentage amount, are removed from the applicant pool, that will also add to the liqudity crisis.

The other issue is PMI (Private Mortgage Insurance) companies. These companies have been all but forgotten in the current subprime meltdown fiasco. They will also begin to suffer as loan defaults will eat into their bottom line and many companies will either go out of business or stop offering such insurances. This will reduce further abilities of population in the US to obtain loans for real estate due to down payment requirements. I believe that the days of 0 down home loans will go by the way of the do do bird.

One thing that struck me as interesting is the current article listing top originators of subprime loans. #1) HSBC #2) New Century (now defunct) #3) Countrywide Financial (CFC)! Yet the company continues to contend that their subprime loan exposure is small. This is another questionable aspect of CFC that needs to be scrutinized because I feel like Angelo Mozillo is not telling the whole truth. Just look at his recent spike in selling activities, as I listed on my prior blog. If the company is doing so well and does not have significant exposure to the subprime market and therefore should not suffer the same fate as Fremont General, New Century, and Accredited Home Lenders, why has the CEO and Chairman of the company's selling activity increased more than three fold over the past year, and especially during the market melt down? Sadly, if CFC ever comes under scrutiny like New Century, more dirt can be dug out at that time. I just don't trust Mozillo right now.

Speaking of trust, did anyone catch the artful double speak that he pulled off on CNBC with Maria Bartaromo? On one hand he reassured the viewers that his company was strong and that his subprime exposure was minimal (see marketwatch.com's article on this). He then turns around and says that the mortgage industry will face severe liquidity crisis and was practically beggin for the FED to cut interest rates. He contends that is the only thing that will save the mortgage industry. Oh really? And why might that be? Perhaps because even the prime lending industry is not clean and many of the loans were originated that were adjustable? Or perhaps the borrowers might have been credit worthy but bit off more than they can chew on their homes? Or is it because every prime lending institutions also have more subprime exposure than they care to admit?

And now FBR comes out with a lame upgrade that means nothing. I just don't buy it. Subprime business is not one that will be beneficial for any companies that are interested in taking over its operation via take overs, buying loans, or driving the competition out of business. The only conclusion that I can derive out of all this is that the insiders and institutions are counting on the "dumb" retail to prop up the share prices while they unload with huge profits. Because at the end of the day the only thing that matters is how much money is in the personal bank. No one really cares about retail anyways. It has always been that way on the Wall Street and the sooner we realize that the better off you are as an investor or a trader.

Lastly, shame on you Paul Miller at FBR for such weak upgrade.

The part that I don't understand is that Paul Miller downgraded Countrywide Financial (CFC) on January 30, 2007 from Outperform to Market Perform. Today on March 14, 2007, just over 2 months later, he flip flopped his opinion to Outperfrom from Market Perform. The main reason behind this upgrade is that Paul Miller assumes that Countrywide Financial (CFC) will survive the subprime meltdown and will emerge as the leader in subprime lending business as a result of other "competitors" going out of business. He contends that Countrywide Financial is strong enough to weather this "storm" and emerge stronger as a result of the purge both in the subprime and prime mortgage lending business. Bottom line is that the business at CFC will grow as a result of these recent activities. I will read the research report when it is available as it is not yet published on the FBR site (Friedman Billings Ramsey).

The erroneous contention that subprime business is a viable model has been ignored by the main stream financial media and the industry. The reason for this may not be too far fetched to consider that the financial community has conflict of interest in terms of share holder welfare and obligations to the companies that they follow. This can take the form of owning shares in the company in the hedge funds or mutual funds that they control, having an investment banking relationship with the company, or having non equity stake in the company. I believe that it is this conflict of interest that misleads the vast majority of shareholders in the "retail" segment of the equity market. At this point it is mere speculation and futile attempts at mental exercise to consider all the reasons for the upgrade other than what is purported to be true by FBR.

One consideration many analysts and pundits fail to realize about the subprime meltdown is that it is not insulated. I have harped on this issue over the past few days on my prior blogs. Even a small exposure to the subprime market can have compounding negative ramifications on the company such as Countrywide Financial. In order to originate the subprime loan, the company takes tremendous risks associated with possible loan default. In exchange, the lending company is rewarded with higher application fees, restrictive clauses in the loan agreement against the borrower (such as early termination fees- which can be as high as 20% of the outstanding principal), and higher interest rates. It is the high rate of return on investment that the subprime market focused on. When it was sexy, not less than 8 months ago, many main stream banks such as HSBC sought out these risky loans to increase their bottom line. Once the subprime slime has been exposed and the "hysteria" has spread in the stock market, these loans are no longer the highly sought after investment vehicles that it once was. A leper has better chances currently. This is creating a severe liquidity crisis, because many of these subprime loans are bought by other investors, banks, and hedge funds for their returns. Right now, it is considered to be about attractive as cow dung. Angelo Mozillo publicly stated that mortgage industry will face severe liqudity crisis for this very same reason. Spillover effect of the subprime meltdown is complicated but if it can be simplified, I would state that the demand for the mortgage loans would be directly proportional to the willing and able loan applicants. The purging of the subprime market does not mean subprime applicant cannot qualify for a loan. It means that the industry must have quantifiable accountability for the loans. Additionally, as the industry cracks down on its lending practices, even prime applicants will have problems obtaining the mortgage that they need because the ristrictions and guidlines will become stricter. Additionally, the same prime applicants who financed their houses are over extended in terms of what they can afford and many have resorted to 5/1 ARMS or its derivatives or have bought houses with interest only loans. It is also purported that many subprime loans were made to illegal aliens and foreign nationals. If these contingents, probably small in sheer percentage amount, are removed from the applicant pool, that will also add to the liqudity crisis.

The other issue is PMI (Private Mortgage Insurance) companies. These companies have been all but forgotten in the current subprime meltdown fiasco. They will also begin to suffer as loan defaults will eat into their bottom line and many companies will either go out of business or stop offering such insurances. This will reduce further abilities of population in the US to obtain loans for real estate due to down payment requirements. I believe that the days of 0 down home loans will go by the way of the do do bird.

One thing that struck me as interesting is the current article listing top originators of subprime loans. #1) HSBC #2) New Century (now defunct) #3) Countrywide Financial (CFC)! Yet the company continues to contend that their subprime loan exposure is small. This is another questionable aspect of CFC that needs to be scrutinized because I feel like Angelo Mozillo is not telling the whole truth. Just look at his recent spike in selling activities, as I listed on my prior blog. If the company is doing so well and does not have significant exposure to the subprime market and therefore should not suffer the same fate as Fremont General, New Century, and Accredited Home Lenders, why has the CEO and Chairman of the company's selling activity increased more than three fold over the past year, and especially during the market melt down? Sadly, if CFC ever comes under scrutiny like New Century, more dirt can be dug out at that time. I just don't trust Mozillo right now.

Speaking of trust, did anyone catch the artful double speak that he pulled off on CNBC with Maria Bartaromo? On one hand he reassured the viewers that his company was strong and that his subprime exposure was minimal (see marketwatch.com's article on this). He then turns around and says that the mortgage industry will face severe liquidity crisis and was practically beggin for the FED to cut interest rates. He contends that is the only thing that will save the mortgage industry. Oh really? And why might that be? Perhaps because even the prime lending industry is not clean and many of the loans were originated that were adjustable? Or perhaps the borrowers might have been credit worthy but bit off more than they can chew on their homes? Or is it because every prime lending institutions also have more subprime exposure than they care to admit?

And now FBR comes out with a lame upgrade that means nothing. I just don't buy it. Subprime business is not one that will be beneficial for any companies that are interested in taking over its operation via take overs, buying loans, or driving the competition out of business. The only conclusion that I can derive out of all this is that the insiders and institutions are counting on the "dumb" retail to prop up the share prices while they unload with huge profits. Because at the end of the day the only thing that matters is how much money is in the personal bank. No one really cares about retail anyways. It has always been that way on the Wall Street and the sooner we realize that the better off you are as an investor or a trader.

Lastly, shame on you Paul Miller at FBR for such weak upgrade.

BIDU Tested the 200 EDMA today.