So, I got to thinking about the rally from last week. It certainly appears that the Bulls are in control right now. The complacency that I have been talking about in the market is again taking form. Investors are comfortable that the correction is all but over. But I have many conflicting signals that say that perhaps this is still a "dead cat bounce". ultimately, I know that I shouldn't fight the tape. But I feel as though the charts must prove more before I will join the band wagon.

Number one item that I am baffled about is the announced Blackrock IPO which is priced at $4 billion dollars. Truly, the media is making a big huge deal out of this, spinning this IPO as one of the biggest in recent times, and extolling virtues of the strength of this economy. As the logic goes, more IPOs there are, the healthier the market. Yet, I have to stop and beg this one question: Why?

I don't have any problem with the IPO market. Without it, the markets cannot sustain itself. But again I ask why? The company's business revolves around buying out publicly traded company and taking them public because there is more value in dismantling the company in question when it goes private or bringing them public after it has been "rehabilitated" and the market begins to "reappreciate the true value" of the company. So, I got to thinking. Why would a company where their business involves taking publicly traded company out of the market because they feel more value and less scrutiny resides in the private sector so that each company can focus on enhancing the business instead of pleasing wall street analysts? Why would a company who believes private is far better than being public want to now join that game that they have tried so hard to get away from?

I cannot believe how pessimistic I have become over the past few years! Perhaps this question is a directly related issue. But none the less, my pessimisim about the Blackrock IPO seems to that Blackrock has an ulterior motive of passing on the risk to the retail investors. I believe that we may have reached an uncertain top in the market. Perhaps Blackrock insiders also realize this. Perhaps they realized that they paid a huge premium to take their respective companies private. In packaging this IPO as a highly publicized event, the demand will be drummed up when it opens. It may even garner high prices. But if anyone hasn't seen the Heely's (HLYS) IPO, the group that is currently left holding the bag are the retail share holders.

Thus I can again connect the dots from this view point on Blackrock and say that this is another sign that the market has topped. The media can hail this event anyway they want to. Under the current circumstances, the game of playing denial and getting as many unsuspecting retail investors to prop up the market while the rest of the smart money gets out has been played to a text book perfection.

The market rally is another one of those events that began March 14th. The follow through day on the NASDAQ was on average volume just 25% greater than prior day's volume. On top of that, the follow through day came only after 3 weeks of correction. I spoke on this aspect a while back, but ideally, you'd like to see at least 7 weeks. The follow up days in the markets again were on light volume. I know that a rally is a rally and I probably missed out on a good 3% market rally but I still stand firm on the short side because a strong follow through day requires more negativity to be built in. The market currently is hoping beyond all hope that the "Goldilocks" still remains. I think this sets us up for more down days ahead. Perhaps judging by the way the market has behaved in a very volatile way, next week may bring back the serious whipsaw that will again have the bulls scurrying. I do not know what that catalyst will be. Will it be Uncle Ben's testimony to congress on Wednesday? Will it be Iran? Will it be the subprime and now the prime Alt-A mortgage issues? I don't know.

I will take my chances and continue to hold my puts on Countrywide. It is gut wrenching but I have to stand behibnd my principal. Unless the market shows me with more evidence and the economy can confirm that the mortgage (noticed how I didn't say subprime?) will not spread to the economy, I will stay this way. Maybe I will lose everything and admit defeat and go about my life in the usual way. But there are worse things that I can think of. But for now, I trust no one and I firmly adhere to "sell the strength and buy the weakness". Good luck everyone! Its rough out there.

Saturday, March 24, 2007

Friday, March 23, 2007

Mazilo Sells Despite Congressional Hearing!

Mazilo in a brazen show of disrespect and gumption, sold another 70,000 shares yesterday even as he was on Cramer's Mad Money pumping his stock. It is very questionable as his lieutenant Sandor Samuels was getting grilled and confessing to the virtual fradulent nature of his business.

This is becoming more and more like Enron each day.

This is becoming more and more like Enron each day.

Update on Housing Market for Friday

Freddie Mac (FRE) officially posted a loss of $480 million dollars, posting 2006 EPS of $2.84 while the analysts were expecting $5.19 to $6.00. This further points to weakness in the housing industry and that it is not isolated to the subprime mortgage market.

Countrywide (CFC) and Indymac (NDE) were officially sued for fraud today, which promises to be the long string of law suits for breach of "fiduciary" duties by a lender. Interestingly Sandor Samuels also agreed that CFC has no "fiduciary" duties to the borrower. Things are getting interesting. I am awaiting more law suits of this type, including class action law suits by the share holders which should lead to SEC criminal probe of this company with CEO Angelo Mozilo at the center of this suit. Enron memories are so bittersweet!

Existing Home Sales numbers are due 10:00 AM EST with estimates at 6.3 million. I think we will see a drastic decline in this area, further boosting the notion that all is well for the mortgage industry and housing industry. No bottom is near. I do not think that Angelo Mozilo's clown act with Cramer last night to pump up his stock will work and it will be further exposed that Mazilo and Cramer is complicit in a pump and dump scheme. I do not think Countrywide can continue to grow as promised with declining home sales.

All of this means that we should see a down day for the home builders and mortgage lenders of every type today. I wonder what the new shoe to drop will be.

Countrywide (CFC) and Indymac (NDE) were officially sued for fraud today, which promises to be the long string of law suits for breach of "fiduciary" duties by a lender. Interestingly Sandor Samuels also agreed that CFC has no "fiduciary" duties to the borrower. Things are getting interesting. I am awaiting more law suits of this type, including class action law suits by the share holders which should lead to SEC criminal probe of this company with CEO Angelo Mozilo at the center of this suit. Enron memories are so bittersweet!

Existing Home Sales numbers are due 10:00 AM EST with estimates at 6.3 million. I think we will see a drastic decline in this area, further boosting the notion that all is well for the mortgage industry and housing industry. No bottom is near. I do not think that Angelo Mozilo's clown act with Cramer last night to pump up his stock will work and it will be further exposed that Mazilo and Cramer is complicit in a pump and dump scheme. I do not think Countrywide can continue to grow as promised with declining home sales.

All of this means that we should see a down day for the home builders and mortgage lenders of every type today. I wonder what the new shoe to drop will be.

More on Jim Cramer

I have always found Cramer to be irresponsible when it comes to making recommendations for stocks to buy. In essence, anyone else doing what he does on TV or the Radio would be under SEC investigation.

I found a great site that tracks all of his recommendations and sees which ones pan out and which ones do not. There was much celebration on this site this week as Cramer beat out the monkey for the first time in stock pick accuracy by 1 pick.

With his recent "pumping" of Angelo Mozilo's company, Countrywide, I believe he has stooped to his all time lows.

Thursday, March 22, 2007

Jim Cramer the Contrarian Indicator

I hate calling people out. It is not in my nature to do so. I have done so few times in my life of which I am not proud of. Jim Cramer is dangerous. He intends to "serve" the average Joe from making informed investment decisions. His show is intended to entertain and educate. Nobody, I mean no body can continuously pick stocks and make recommendations day in and day out without running out of ideas and ultimately be wrong. Jim Cramer has been wrong and has been dead wrong on many occasions. I have read all of his books and much of what you will read will be self promoting. But in "The Confessions of a Street Addict", he also recounts many a times when he was wrong and believed his ideas to be right that nearly cost him his Hedge fund. Examples would be his belief in what the Cendant insiders were telling him about the company which he rode down before realizing that he was taken for a fool. He later testified against some of those insiders during SEC trial that put these people in jail. Talk about vindictive. Yet, he portrays himself as a unerring guru on par with Jesse Livermore, William O'Neal, Peter Lynch, Warren Buffet, and sadly, he is not. He is a lucky man who had breaks that got him where he is today. He also got people out at the bottom of the bear market in 1998 when he told his news letter subscribers to, and I quote "Get Out!". Needless to say, he lost a lot of his "lemmings" a lot of money.

More recently, here is his Mad Money Recap from January 30, 2005:

Why shouldn't Silicon Graphics (SGI - commentary - Cramer's Take) be bought? The company's in a turnaround. Its customers, oil companies and the government via defense and NASA, are flush with cash. Management has extricated itself from a toxic convert, as Frank Husic, a terrific growth stock manager, pointed out last night on "Kudlow & Cramer."

And the darned stock's at 3 smackers! Three bucks!

When you consider that people jump up and down to own that piece of junk Sun Microsystems (SUNW - commentary - Cramer's Take), which was an overcharging bandit during the heyday, or when you consider the love affair people have with Ted Waitt at Gateway (GTW - commentary - Cramer's Take) despite his insistence on doing nothing right, including this morning's wacky purchase of eMachines, the Silly Graphics choice makes a lot of sense.

When you add in the bizarre fact that not a single major firm covers Silicon Graphics, I say the darned thing sounds like a screaming buy!

Should you wait until it cools off, given the goosing it received on television? I would.

But then again, I would put some on now, so as not to forget it when the hoopla dies down.

Random musings: No sooner had Disney (DIS - commentary - Cramer's Take) CEO Michael Eisner kiboshed the Pixar (PIXR - commentary - Cramer's Take) deal, the single most important part of the Disney turnaround, than his minions were all over the media with some cockamamie story about how this was good for Disney. Man, you gotta love Hollywood. It's got the Kremlin and old Mother Russia beat for spin control.

The Cramer article is in red. I want you to focus on Sun Microsystems(SUNW) and Silicon Graphics (SGI). In this article, he is trashing Sun Microsystems and recommending Silicon Graphics. Why is he so negative on Sun Microsystems? He had the CEO on the show few weeks before where he painted a glowing picture of Sun's turn around and because Cramer liked him, he said he would buy it. Of course, few weeks later, news came out that the CEO wasn't being forthright with him. He of course played the victim and said, and I quote "

Feeling Used by Sun Microsystems". Shortly after this article was published, he had the CEO of Silicon Graphics on the show for an "interview". He asked him soft ball questions and the CEO again painted a rosy picture on the turn around of the company. A few weeks later, when SGI shares fell, Cramer publicly condemned the company by saying "Feeling Used by Sillicon Graphics". Since then he trashed the company as much as he can.

The one constant about Cramer is that he is consistent. He is a perma-bull. He sometimes holds on to losing investments while getting others to go "down" with the boat with him. So now that I have filled you in on his history in brief, I would like to now focus on Countrywide Financial. He had Angelo Mozilo who appeared on today's Mad Money Show. How convenient! He couldn't make the Senate investigation, instead sending Sandor Samuels, the Chief Legal Officer to do the dirty work under oath (Read: My previous blog on this topic). Instead, he appears on Mad Money show and spews his propaganda and poor old gullible Cramer bought all of it. Cramer prides himself in doing more due diligence than anyone. Yet he seems to just buy into what Mozilo has to say based on the fact that in Cramer's opinion, Mozilo is a "good guy in the industry". Mozilo again told the audience that Countrywide will emerge strong from the subprime melt down and hinted that they have not made any subprime loans that Accredited (LEND) and New Century (NEWC.PK) have made. That is complete falsehood. The fact is, Countrywide has been making those loans and according to Sandor Samuels, he expects the foreclosures from Countrywide's subprime loans to increase. Additionally, clearly, Samuels also testified that 60% of loan applicants cannot qualify for the prime loans for Countrywide if legislative restrictions were put forth. I am just waiting for Cramer to play the poor victim in a few weeks just like with Sun Microsystems and Silicon Graphics.

I find this despicable. I find the actions of Angelo Mozilo sick. He will have much to explaining to do in the near future. Greed is a powerful agent of evil.

More recently, here is his Mad Money Recap from January 30, 2005:

Why shouldn't Silicon Graphics (SGI - commentary - Cramer's Take) be bought? The company's in a turnaround. Its customers, oil companies and the government via defense and NASA, are flush with cash. Management has extricated itself from a toxic convert, as Frank Husic, a terrific growth stock manager, pointed out last night on "Kudlow & Cramer."

And the darned stock's at 3 smackers! Three bucks!

When you consider that people jump up and down to own that piece of junk Sun Microsystems (SUNW - commentary - Cramer's Take), which was an overcharging bandit during the heyday, or when you consider the love affair people have with Ted Waitt at Gateway (GTW - commentary - Cramer's Take) despite his insistence on doing nothing right, including this morning's wacky purchase of eMachines, the Silly Graphics choice makes a lot of sense.

When you add in the bizarre fact that not a single major firm covers Silicon Graphics, I say the darned thing sounds like a screaming buy!

Should you wait until it cools off, given the goosing it received on television? I would.

But then again, I would put some on now, so as not to forget it when the hoopla dies down.

Random musings: No sooner had Disney (DIS - commentary - Cramer's Take) CEO Michael Eisner kiboshed the Pixar (PIXR - commentary - Cramer's Take) deal, the single most important part of the Disney turnaround, than his minions were all over the media with some cockamamie story about how this was good for Disney. Man, you gotta love Hollywood. It's got the Kremlin and old Mother Russia beat for spin control.

The Cramer article is in red. I want you to focus on Sun Microsystems(SUNW) and Silicon Graphics (SGI). In this article, he is trashing Sun Microsystems and recommending Silicon Graphics. Why is he so negative on Sun Microsystems? He had the CEO on the show few weeks before where he painted a glowing picture of Sun's turn around and because Cramer liked him, he said he would buy it. Of course, few weeks later, news came out that the CEO wasn't being forthright with him. He of course played the victim and said, and I quote "

Feeling Used by Sun Microsystems". Shortly after this article was published, he had the CEO of Silicon Graphics on the show for an "interview". He asked him soft ball questions and the CEO again painted a rosy picture on the turn around of the company. A few weeks later, when SGI shares fell, Cramer publicly condemned the company by saying "Feeling Used by Sillicon Graphics". Since then he trashed the company as much as he can.

The one constant about Cramer is that he is consistent. He is a perma-bull. He sometimes holds on to losing investments while getting others to go "down" with the boat with him. So now that I have filled you in on his history in brief, I would like to now focus on Countrywide Financial. He had Angelo Mozilo who appeared on today's Mad Money Show. How convenient! He couldn't make the Senate investigation, instead sending Sandor Samuels, the Chief Legal Officer to do the dirty work under oath (Read: My previous blog on this topic). Instead, he appears on Mad Money show and spews his propaganda and poor old gullible Cramer bought all of it. Cramer prides himself in doing more due diligence than anyone. Yet he seems to just buy into what Mozilo has to say based on the fact that in Cramer's opinion, Mozilo is a "good guy in the industry". Mozilo again told the audience that Countrywide will emerge strong from the subprime melt down and hinted that they have not made any subprime loans that Accredited (LEND) and New Century (NEWC.PK) have made. That is complete falsehood. The fact is, Countrywide has been making those loans and according to Sandor Samuels, he expects the foreclosures from Countrywide's subprime loans to increase. Additionally, clearly, Samuels also testified that 60% of loan applicants cannot qualify for the prime loans for Countrywide if legislative restrictions were put forth. I am just waiting for Cramer to play the poor victim in a few weeks just like with Sun Microsystems and Silicon Graphics.

I find this despicable. I find the actions of Angelo Mozilo sick. He will have much to explaining to do in the near future. Greed is a powerful agent of evil.

Bond Yield Rises, Oil Rises, Mortgage regulators and Lenders Get Grilled by Congress, Stocks Fail to Follow Through

It only took 24 hours for the investors to rethink the "dovish" comments by the FED. As I have said yesterday, there was no "dovish" statement by the FED yesterday. I believe that the investors got irrationally exuberant yesterday. As have been the norm lately, an apparently perfect bullish set up failed to materialize. We discussed yesterday that many bears got trapped on March 14 break below 12,000 on the DOW on strong volume only to have the stock roar back up. So it is not surprising that yesterday's follow through on the NASDAQ was met today with tepid response. I would probably give this market until tomorrow to continue to follow through on strong volume. Many of the prior leaders continue to charge up on tepid volume like Google, BIDU, ISRG, AAPL, but volume continues to lag. Additional drag on the technology sector was apparent due to the weak Motorola earnings report. We need to keep in mind that earnings will drastically slow down for many companies going forward and yesterday's FED led rally is nothing really to cheer about.

OIL jumped more than $2 to end the day at $61.92. Oil should continue to gain steam ahead of continued rise in usage and ecalating tensions in the Middle East. With all the drama with subprime mortgage, people have forgotten about the Middle East issues. Iran continues to remain defiant and the development in that region needs vigilance. We cannot be off our guard. Rising oil can only mean further pressure on inflation, the media cannot spin that one.

Bond yields rose today and dollar regained some luster today as reassessment of the FED statement yesterday is probably bringing traders down to earth. We are still in a unmoderating inflation environment, slowing US economy, and housing problems. I do not think a rate cut will do this economy any good at this point. Instead of focusing on inflation, the greater market and the FED needs to stand up and start facing the possiblity of stagflation if the interest rates do not come up. I used to be against interest rate hikes but I see the utility now not because I am now bearish on the economy, but the threat of unbridled rise in inflation is the single most important concern on our economy and our standard of life. Many would argue that if we do not cut interest rate soon, there will be a massive credit crunch leading to abrupt slow down in the economy and lead to recession. But I think some short to intermediate pain in the form of a recession to wash out the credit excess that has created this problem is infinitely better than the alternative which is stagflation. The prospects are real. i am working on the nuances of why stagflation is possible in the near future.

Today's investigation by Senate Banking Comittee headed by Senator Dodd was the most eye opening event that I have seen in a long time. The complacency and utter fradulent behaviors of the subprime lender was astounding. In the words of Sandor Samuels of Countrywide Financial, I am paraphrasing, they have no fiduciary responsibility other than getting the loan to the people that need them. As long as Countrywide can make money, they have no moral obligation to make sure that their actions do not contribute to the overall downfall of people, country, and the economy. I think it is too late for this company and for many lending institutions. Countrwide also finally admitted that over 60% of their mortgage applicants cannot qualify for a regular indexed loans which means that they are "subprime" even though Countrywide has repeated in the past that the subprime loan only consists of 7% of their entire portfolio. They are lying and they know it. That is why the insiders continue to dump the shares and the institutions are secretly dumping shares right now. The stock is propped up by phantom buy backs on more debt and disingenuous analyst ratings to get the "retail" investors to buy into the BS while they dump the shares. Some may point out that the recent liquidity crunch faced by Fremont and Accredited Home Lenders by the hedge fund was a testiment that this economy can handle this crisis, as the companies testified to the congress today. But you have to laugh at that logic. Accredited got funding, or a "pay day predatory lending loan" at 13% with warrants to make sure that the Hedge fund is covered in all angles. The Hedge fund did not loan them the money out of goodness of their heart. They loaned Accredited money so that they can divest their 4% stake in the company, collect the 13% loan interest, gain 3million shares of warrants, and then they can short Accredited to hedge against them. This type of loan will only allow Accredited to stay afloat long enough for the Hedge fund and institutions to dump and get out while the retail is enticed again to hold the bag. It is very sad that people just don't understand the game.

I am waiting for the next shoe to drop in this market, that is why I am short.

OIL jumped more than $2 to end the day at $61.92. Oil should continue to gain steam ahead of continued rise in usage and ecalating tensions in the Middle East. With all the drama with subprime mortgage, people have forgotten about the Middle East issues. Iran continues to remain defiant and the development in that region needs vigilance. We cannot be off our guard. Rising oil can only mean further pressure on inflation, the media cannot spin that one.

Bond yields rose today and dollar regained some luster today as reassessment of the FED statement yesterday is probably bringing traders down to earth. We are still in a unmoderating inflation environment, slowing US economy, and housing problems. I do not think a rate cut will do this economy any good at this point. Instead of focusing on inflation, the greater market and the FED needs to stand up and start facing the possiblity of stagflation if the interest rates do not come up. I used to be against interest rate hikes but I see the utility now not because I am now bearish on the economy, but the threat of unbridled rise in inflation is the single most important concern on our economy and our standard of life. Many would argue that if we do not cut interest rate soon, there will be a massive credit crunch leading to abrupt slow down in the economy and lead to recession. But I think some short to intermediate pain in the form of a recession to wash out the credit excess that has created this problem is infinitely better than the alternative which is stagflation. The prospects are real. i am working on the nuances of why stagflation is possible in the near future.

Today's investigation by Senate Banking Comittee headed by Senator Dodd was the most eye opening event that I have seen in a long time. The complacency and utter fradulent behaviors of the subprime lender was astounding. In the words of Sandor Samuels of Countrywide Financial, I am paraphrasing, they have no fiduciary responsibility other than getting the loan to the people that need them. As long as Countrywide can make money, they have no moral obligation to make sure that their actions do not contribute to the overall downfall of people, country, and the economy. I think it is too late for this company and for many lending institutions. Countrwide also finally admitted that over 60% of their mortgage applicants cannot qualify for a regular indexed loans which means that they are "subprime" even though Countrywide has repeated in the past that the subprime loan only consists of 7% of their entire portfolio. They are lying and they know it. That is why the insiders continue to dump the shares and the institutions are secretly dumping shares right now. The stock is propped up by phantom buy backs on more debt and disingenuous analyst ratings to get the "retail" investors to buy into the BS while they dump the shares. Some may point out that the recent liquidity crunch faced by Fremont and Accredited Home Lenders by the hedge fund was a testiment that this economy can handle this crisis, as the companies testified to the congress today. But you have to laugh at that logic. Accredited got funding, or a "pay day predatory lending loan" at 13% with warrants to make sure that the Hedge fund is covered in all angles. The Hedge fund did not loan them the money out of goodness of their heart. They loaned Accredited money so that they can divest their 4% stake in the company, collect the 13% loan interest, gain 3million shares of warrants, and then they can short Accredited to hedge against them. This type of loan will only allow Accredited to stay afloat long enough for the Hedge fund and institutions to dump and get out while the retail is enticed again to hold the bag. It is very sad that people just don't understand the game.

I am waiting for the next shoe to drop in this market, that is why I am short.

In Review of Insider Sales at Countrywide

So, I ran into this old blog from January 25, 2007 on Herb Greenberg's site at marketwatch.com.

Curious Tale: Countrywide Insiders Bail

In the wake of chatter of a possible Bank of America (boa) buyout of Countrwide Financial, something that bears watching -- especially if there is NO deal at a big price and/or if earnings released Tuesday are terrible: Whether anybody asks Countrwide (cfc) on its earnings call tomorrow about insider sales by top execs, most notably CEO Angelo Mozilo, who has been an unusually active seller in recent months. Since the company's announcement in October of a plan to repurchase up to $2.5 billion of its shares during the fourth quarter (using borrowed funds) Mozilo has created three different 10b5 plans, which calls for a routine sales. Since November 11 he has sold more than 1.2 million shares valued at more than $40 million. These are options-related sales, which by itself is irrelevant, with one twist: The options wouldn't have expired for four to five more years.

The beat goes on...

We need to take into context of all the spin that the media and the Wall Street has put on this stock. The reason for this stock holding up so well despite growing evidence of malfeascence of its insider is the following:

1. Many Mutual Funds, Hedge Funds, and institutions own sizeable percentages of this stock.

2. Countrywide is a loved stock on Wall Street.

3. Media propaganda and public denial of problems with mortgages and its implications.

4. "Phantom Buybacks" with borrowed money while the insiders dump like its going out of style.

Just look at what Angelo Mozilo is doing by exercising and then selling his stock options that are no where near expiration. Insider dumping was pronounced even today as Sandor Samuels testified in front of congress. More on that on my next blog.

Curious Tale: Countrywide Insiders Bail

In the wake of chatter of a possible Bank of America (boa) buyout of Countrwide Financial, something that bears watching -- especially if there is NO deal at a big price and/or if earnings released Tuesday are terrible: Whether anybody asks Countrwide (cfc) on its earnings call tomorrow about insider sales by top execs, most notably CEO Angelo Mozilo, who has been an unusually active seller in recent months. Since the company's announcement in October of a plan to repurchase up to $2.5 billion of its shares during the fourth quarter (using borrowed funds) Mozilo has created three different 10b5 plans, which calls for a routine sales. Since November 11 he has sold more than 1.2 million shares valued at more than $40 million. These are options-related sales, which by itself is irrelevant, with one twist: The options wouldn't have expired for four to five more years.

The beat goes on...

We need to take into context of all the spin that the media and the Wall Street has put on this stock. The reason for this stock holding up so well despite growing evidence of malfeascence of its insider is the following:

1. Many Mutual Funds, Hedge Funds, and institutions own sizeable percentages of this stock.

2. Countrywide is a loved stock on Wall Street.

3. Media propaganda and public denial of problems with mortgages and its implications.

4. "Phantom Buybacks" with borrowed money while the insiders dump like its going out of style.

Just look at what Angelo Mozilo is doing by exercising and then selling his stock options that are no where near expiration. Insider dumping was pronounced even today as Sandor Samuels testified in front of congress. More on that on my next blog.

Wednesday, March 21, 2007

Was Today a Bullish Reversal?

It very well may have been. The next couple of days will prove this. In times like this, you must throw out your previous bias and heed what the market is telling you. A lot of shorts got caught and squeezed today, including myself. I however did not sell into this panic. My rule has always been that just when things feel like it has gone to "hell" and that primitive urge to "fight or flight" is when a true trader can test whether or not he truly has conviction. Of course, a seasoned trader will also acknowledge that his primary duty is to protect his hard earned capital and cut losses quickly. Within context of this market, one must also become flexible and become more flexible if he or she is to trade in this dangerous environment.

Today was a broad rally, spurred by the FED comments and their decision to leave the interest rates unchanged. This interest rate policy was widely anticipated. What is perplexing about this rally is that the FED comments were not at all dovish. Because the FED changed the sentence and word structure of their policy statement, the market perceived this as an end to rate hikes. But when you read the statement without trying to find the implicit or explicit meanings the FED is still concerned about the high inflation and that the housing issue is an ongoing issue. There was no where in the statement that would be even suggestive of the fact that the FED is considering cutting rates or that they will even consider that. All we know is that the inflation is acknowledged as being above their comfort level and that they will continue to be vigilant in combating inflation.

Please see this site as this breaks down and compares the FED policy statemetns:

http://calculatedrisk.blogspot.com/2007/03/fed-weaker-economy-more-inflation.html

Additionally, while technically, today can be consider the "follow" through day, I believe it is a bit early in the correction cycle to have much validity. Usually, according to IBD, a follow through that has the highest rate of success the one that occurrs after at least 7 weeks of correction cycle. Additionally, the follow through day is defined as a bullish movement in one of the major indices on strong volume of at least 1.7% on the fourth day to the 7th day, after the first attempted rally. Additionally, all bullish uptrend started with a follow through day but not all follow through day leads to a bullish uptrend. This bullish movement began last Thursday which counted as day 1 and today's follow through was day 5 of that attempted rally. Today's breadth was strong. 9:1 ratio of advancers to decliners put an exclamation point to today's follow through. It has been mentioned that a day like today where the advancers trumped decliners, especially on a follow through day means that the bullish movement is especially strong. That is true whenc onsidering historically when the follow through day had such incredible breadth.

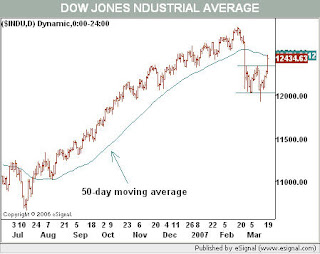

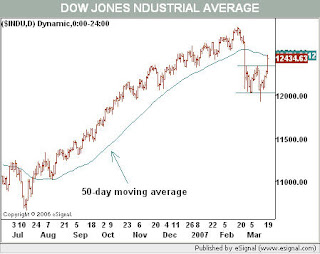

But an article on today's Barron's Online syndicated article Getting Technical "Is It Morning in the Stock Market?", he has presented an interesting view that perhaps this is the volatility inherent within the bear phase market that has left both the bulls and bears running for cover. He point out that on March 7 Getting Technical showed that the chart pattern exhibited at that time resembled the chart pattern from 1994 and 1999 peaks which lead to a trap after breaking above the trading range, which eerily similar to today's situation.

He also points out that on March 14th, when the Dow fell more than 136 points intraday and breaking support underneath the 12,000 level, the bears seemed to have the upper hand only to reverse above the support level causing a bear trap. Thus when looking at the chart shown below, you will see that this pattern shown both today's bullish follow through and the bearish breakdown on March 14th, some concerns. Notice the extreme ranges on the chart breaking through the support and resistance parallel lines?

He also points out that on March 14th, when the Dow fell more than 136 points intraday and breaking support underneath the 12,000 level, the bears seemed to have the upper hand only to reverse above the support level causing a bear trap. Thus when looking at the chart shown below, you will see that this pattern shown both today's bullish follow through and the bearish breakdown on March 14th, some concerns. Notice the extreme ranges on the chart breaking through the support and resistance parallel lines?

I am not trying to discredit today's follow through. I just want the readers to acknowledge the fact that not all follow throughs lead to bullish uptrend. We are still in a technically broken market and any bullish complacency that might drift into the market, it may be met with unexpected whip saw that will have the bulls scurrying for the exits. Too many economical issues both macro and micro, exists to be comfortable in this environment. Additionally, this rally seemed to have been fueled by desperate short covering which exaggerated the movement today. But it is also true that no rally ever started with out the "short squeeze".

We will see tomorrow what the fate holds for the market. But for now, the best place to be in is cash. In a bear phase extremes in volatility exists and just when you get comfortable, the old man market casts a nasty dose of whipsaw.

I will be watching with great enthusiasm what might unfold tomorrow when Senator Dodd investigates the subprime mortgage leaders on what might have gone wrong. I still remain very skepticle about Countrywide and their insider selling issues and whether they will be as strong as they say they will be once the dust settles from the subprime fall out. I am leary of the fact that Mr. Mozilo did not personally attend to discuss this important issue and clear his company's name, granted it is not a trial, but there is so much chatter about this company, you would think that if he had nothing to hide, he would jump at the opportunity to clear his company and his name.

On several fronts, Apple seems to have the momentum to the upside and many prior leaders such as Google, BIDU, ISRG have gained a solid footing today. We will see if that continues. BIDU also has broken the $100 mark in convincing fashion today. Barring a bearish reversal, I believe that this company has possibly began the move to the upside. We will see.

As for Countrywide (CFC), I remain short term, intermediate term, and long term bearish. I am awaiting the next shoe to drop for this company. I also read an interesting article today on Dow News Wire that questioned formally Mr. Mozilo's increased firesale activity. This story keeps getting better and better. I remain short in this stock, though I took a big hit today, I am not rattled. It has become a cause for me to keep digging.

You can read Michael Kahn's article on his syndicated column Getting Technical on Barron's Online.

Please stay safe and go to cash in these uncertain times. It is not what it seems.

Today was a broad rally, spurred by the FED comments and their decision to leave the interest rates unchanged. This interest rate policy was widely anticipated. What is perplexing about this rally is that the FED comments were not at all dovish. Because the FED changed the sentence and word structure of their policy statement, the market perceived this as an end to rate hikes. But when you read the statement without trying to find the implicit or explicit meanings the FED is still concerned about the high inflation and that the housing issue is an ongoing issue. There was no where in the statement that would be even suggestive of the fact that the FED is considering cutting rates or that they will even consider that. All we know is that the inflation is acknowledged as being above their comfort level and that they will continue to be vigilant in combating inflation.

Please see this site as this breaks down and compares the FED policy statemetns:

http://calculatedrisk.blogspot.com/2007/03/fed-weaker-economy-more-inflation.html

Additionally, while technically, today can be consider the "follow" through day, I believe it is a bit early in the correction cycle to have much validity. Usually, according to IBD, a follow through that has the highest rate of success the one that occurrs after at least 7 weeks of correction cycle. Additionally, the follow through day is defined as a bullish movement in one of the major indices on strong volume of at least 1.7% on the fourth day to the 7th day, after the first attempted rally. Additionally, all bullish uptrend started with a follow through day but not all follow through day leads to a bullish uptrend. This bullish movement began last Thursday which counted as day 1 and today's follow through was day 5 of that attempted rally. Today's breadth was strong. 9:1 ratio of advancers to decliners put an exclamation point to today's follow through. It has been mentioned that a day like today where the advancers trumped decliners, especially on a follow through day means that the bullish movement is especially strong. That is true whenc onsidering historically when the follow through day had such incredible breadth.

But an article on today's Barron's Online syndicated article Getting Technical "Is It Morning in the Stock Market?", he has presented an interesting view that perhaps this is the volatility inherent within the bear phase market that has left both the bulls and bears running for cover. He point out that on March 7 Getting Technical showed that the chart pattern exhibited at that time resembled the chart pattern from 1994 and 1999 peaks which lead to a trap after breaking above the trading range, which eerily similar to today's situation.

He also points out that on March 14th, when the Dow fell more than 136 points intraday and breaking support underneath the 12,000 level, the bears seemed to have the upper hand only to reverse above the support level causing a bear trap. Thus when looking at the chart shown below, you will see that this pattern shown both today's bullish follow through and the bearish breakdown on March 14th, some concerns. Notice the extreme ranges on the chart breaking through the support and resistance parallel lines?

He also points out that on March 14th, when the Dow fell more than 136 points intraday and breaking support underneath the 12,000 level, the bears seemed to have the upper hand only to reverse above the support level causing a bear trap. Thus when looking at the chart shown below, you will see that this pattern shown both today's bullish follow through and the bearish breakdown on March 14th, some concerns. Notice the extreme ranges on the chart breaking through the support and resistance parallel lines?I am not trying to discredit today's follow through. I just want the readers to acknowledge the fact that not all follow throughs lead to bullish uptrend. We are still in a technically broken market and any bullish complacency that might drift into the market, it may be met with unexpected whip saw that will have the bulls scurrying for the exits. Too many economical issues both macro and micro, exists to be comfortable in this environment. Additionally, this rally seemed to have been fueled by desperate short covering which exaggerated the movement today. But it is also true that no rally ever started with out the "short squeeze".

We will see tomorrow what the fate holds for the market. But for now, the best place to be in is cash. In a bear phase extremes in volatility exists and just when you get comfortable, the old man market casts a nasty dose of whipsaw.

I will be watching with great enthusiasm what might unfold tomorrow when Senator Dodd investigates the subprime mortgage leaders on what might have gone wrong. I still remain very skepticle about Countrywide and their insider selling issues and whether they will be as strong as they say they will be once the dust settles from the subprime fall out. I am leary of the fact that Mr. Mozilo did not personally attend to discuss this important issue and clear his company's name, granted it is not a trial, but there is so much chatter about this company, you would think that if he had nothing to hide, he would jump at the opportunity to clear his company and his name.

On several fronts, Apple seems to have the momentum to the upside and many prior leaders such as Google, BIDU, ISRG have gained a solid footing today. We will see if that continues. BIDU also has broken the $100 mark in convincing fashion today. Barring a bearish reversal, I believe that this company has possibly began the move to the upside. We will see.

As for Countrywide (CFC), I remain short term, intermediate term, and long term bearish. I am awaiting the next shoe to drop for this company. I also read an interesting article today on Dow News Wire that questioned formally Mr. Mozilo's increased firesale activity. This story keeps getting better and better. I remain short in this stock, though I took a big hit today, I am not rattled. It has become a cause for me to keep digging.

You can read Michael Kahn's article on his syndicated column Getting Technical on Barron's Online.

Please stay safe and go to cash in these uncertain times. It is not what it seems.

Update on CFC and BIDU

BIDU apparently has found spport at the 200 EDMA and is now bouncing off that level and challenging the $100 level. If the stock breaks $100 on strong volume, we can confirm that a new uptrend has started for this stock. But if it fails to break $100 and reverses on strong volume, we can expect to see $93 to $85 in short order.

CFC is currently is also edging slightly higher up $.20 to $35.42 on my Level II quotes. This is on very light volume and there appears to be congestion with the ceiling at $36.50 and floor at $34.79. The market is very cautious ahead of the FOMC results today. It is scheduled to be released at 2:30PM EST. I see some shorts covering their positions ahead of the announcement.

FOMC is most likely going to keep the rates steady but their policy statement will move the markets either up or down. In all likelihood, the FOMC must confront the rising issues with subprime, which they may down play as being anything of significance in order to keep the markets from being spooked. But the duty of FED is to keep the inflation under control and to guarantee that the economy will continue to expand at healthy levels. In order to do this, they must acknowledge the suprime crisis and also be honest about their policy and not pander to the market's whims and realize that they do not exist to prop up the markets but to ensure long term expansion of this economy.

CFC is currently is also edging slightly higher up $.20 to $35.42 on my Level II quotes. This is on very light volume and there appears to be congestion with the ceiling at $36.50 and floor at $34.79. The market is very cautious ahead of the FOMC results today. It is scheduled to be released at 2:30PM EST. I see some shorts covering their positions ahead of the announcement.

FOMC is most likely going to keep the rates steady but their policy statement will move the markets either up or down. In all likelihood, the FOMC must confront the rising issues with subprime, which they may down play as being anything of significance in order to keep the markets from being spooked. But the duty of FED is to keep the inflation under control and to guarantee that the economy will continue to expand at healthy levels. In order to do this, they must acknowledge the suprime crisis and also be honest about their policy and not pander to the market's whims and realize that they do not exist to prop up the markets but to ensure long term expansion of this economy.

Countrywide To Send The Chief Legal Officer for Hearings

In another turn of events that raises an eye brow or two, Countrywide Financial agreed to participate in the SEC investigation. While most companies are sending their CEO or President to testify under oath, Countrywide Financial is sending their Managing Director/Chief Legal Officer, Sandor "Sandy" Samuels, to testify.

What is troubling about Countrywide's decision to send Sandor Samuels is that it continues to raise questions of integrity and fair play by Angelo Mozilo who is the chief archetect of that company and no one else can have more insight of the operations of the company. The question that needs to be raised is this, "why is Mr. Mozilo sending his top lieutenant when he himself can gain credibility by publicly testifying about the fairness of his business model and legality of his recent "fire" sales of his stocks". I can only infer that Mr. Mozilo actually has more to hide than meets the eye.

I believe the next shoe to drop for the mortgage and housing sector is this event. I have faith that senator Dodd will ask tough questions ranging from validity and morality of "Liar" loans, subprime mortgage process, and excessive insider sales of stock. While I do not believe any "material" information will be garnered from this hearing, it will raise some poignant questions within the media who has been playing cheerleader for the mortgage companies as of late. It will make it hard for the companies to manipulate informational stream to the public to prop up shares while the insiders continue to sell shares of their companies.

Furthermore, it may raise awareness that the problems within the mortgage company is not isolated to the subprime sector and that further escalation of this problem into other mainstream mortgage sectors may be possible.

Countrywide may have as well chosen the path of New Century by outright refusing to participate in this testimony. Even though I anticipate that Countrywide will continue to play ignorant, naive, or take the 5th, the public perception of this company will be raised. That this company is not above the intelligence of the good people of America. In pursuit of profits and insider greed, Countrywide has done more to harm the "American Dream" by making unrealistic goals achievable. The only thing that will be garnered from this testimony will be corporate greed and the arrogance of Angelo Mozilo.

Angelo Mozilo why are you hiding?

What is troubling about Countrywide's decision to send Sandor Samuels is that it continues to raise questions of integrity and fair play by Angelo Mozilo who is the chief archetect of that company and no one else can have more insight of the operations of the company. The question that needs to be raised is this, "why is Mr. Mozilo sending his top lieutenant when he himself can gain credibility by publicly testifying about the fairness of his business model and legality of his recent "fire" sales of his stocks". I can only infer that Mr. Mozilo actually has more to hide than meets the eye.

I believe the next shoe to drop for the mortgage and housing sector is this event. I have faith that senator Dodd will ask tough questions ranging from validity and morality of "Liar" loans, subprime mortgage process, and excessive insider sales of stock. While I do not believe any "material" information will be garnered from this hearing, it will raise some poignant questions within the media who has been playing cheerleader for the mortgage companies as of late. It will make it hard for the companies to manipulate informational stream to the public to prop up shares while the insiders continue to sell shares of their companies.

Furthermore, it may raise awareness that the problems within the mortgage company is not isolated to the subprime sector and that further escalation of this problem into other mainstream mortgage sectors may be possible.

Countrywide may have as well chosen the path of New Century by outright refusing to participate in this testimony. Even though I anticipate that Countrywide will continue to play ignorant, naive, or take the 5th, the public perception of this company will be raised. That this company is not above the intelligence of the good people of America. In pursuit of profits and insider greed, Countrywide has done more to harm the "American Dream" by making unrealistic goals achievable. The only thing that will be garnered from this testimony will be corporate greed and the arrogance of Angelo Mozilo.

Angelo Mozilo why are you hiding?

Tuesday, March 20, 2007

Do the Right Thing Mr. Bernake

I am an optimist at heart. I am also a bull at heart. But I am also able to change with the times. Today and for the unforseeable future, I am a bear. Tomorrow at 2:15 PM EST, FOMC will release their policy statement. Many pundits conclude that it is a foregone conclusion that the FED will remain steady with their interest rate at 5.25%. What will be listend to closely tomorrow is the "language" of the FOMC. Many economists and equities players want to hear a "dovish" FED statements tomorrow that will hopefully signal the end of the tightening bias of the FED. What will be most closely watched is if there is any indication that the interest rates will be cut in the near future.

The markets rallied for the past two days based on the premise that the FED will hold the interest rates steady and that the language of the policy statement will reflect a change in tone to a dovish stance which would further invigorate the market. Many are clamoring or worse, begging for a rate cut. Some have even gone as far as to predict that an interest rate cut will come as early as May. Because deep down at the core of the majority of the market's wishes is to keep the market rally going. No one wants the party to end. But sadly, like all good things, all things must have a beginning and an end.

The specter of recession looms large. We have seen the first early warning shots that our economy is not all right from the recent subprime melt down. Many would want the FED to step in, play the role of a good guy, and "save" the markets from the recent "turmoil". That would include a dovish statement from the FED, indication that tightening bias is done, and a wink and a nod that the rate cuts are near. That wishful thinking is erroneous.

First thing that everyone needs to understand is that the tightening bias of the FED that began June 2004 that brought the current rates up to 5.25% was implemented to ease the housing bubble that was looming large. The effect was to tighten the credit availability to cool the economy. The FOMC policy of easing interest rates to combat the post 2001 dot com era melt down was artificially engineered to prop up the economy and to induce stimulus to the economy. That stimulus then created the next bubble that is housing. One must seriously consider that the rate hike campaign was to take the excess that existed in the housing and credit markets. Now that the pin has began to prick the subprime excess, many are calling for the FED to stop that they have done enough. If Ben Bernake and Co at FOMC are true to the policies set forth by Alan Greenspan, then they must continue to maintain the tightening bias because we are not done with fighting inflation.

FOMC must battle still high inflation risk versus saving the equity and housing market. The US economy is widely believed to be slowing down to 2-3% growth for 2007 and 2008. I think that the economy is cooling as expected by the FOMC and these measured rate hikes are not to blame for the possible recession that may take place. The easy credit and the go-go housing boom is not fully contained. FOMC must consider that the subprime pruge has not yet ended and that ALT-A Option ARMS pose significant risks to the economy. The interest rate policy of FOMC must be focused and true to their intended purpose. That is to fight inflation and to keep US economy growing at a reasonable rate. If FOMC does not heed their original intended plan, and give into the whims of the market or for political aims, this economy will falter into possible stagflation. Stagflation can be characterized by the 1970's where inflation was sky high and US economic growth was nil. That is exactly what the FOMC statement tomorrow has the potential to avoid or create.

What must be done in this economic environment is to reduce the excess liquidity from easy credit and high inflation. To do that, the FED must do the right thing by acknowledging that the inflation remains critical concern of the FOMC and that further policy will be dependent on the core inflation rates. As our recent PPI and CPI indicates, we are not there yet. Job growth and unemployment is still robust enough for the FOMC to stay in a tightening bias. It may be short term pain for the US economy if the FED resumes tightening the interest rates, but the prospect of a recession versus stagflation, should have the FED doing the right thing. That is to continue to let excess out of the subprime and prime mortgage markets. Acknowledge that the mortgage sector is in need of serious reform, purge the subprime and prime slime that infects our economy. Mr. Bernake has the rare opportunity to do the right thing that may not be seen as being too popular but for the welfare of the future of our economy, he must stay vigilant about fighting inflation, now more than ever. Otherwise, sadly, Mr. Bernake may go the way of Mr. Greenspan, who will trade one boom for another, and cause instability and pain in the American economy.

Mr. Bernake, do the right thing. I know you can do it. The right thing is always the hardest. If you stand for what you truly believe as an accomplished academic, please do the right thing.

The markets rallied for the past two days based on the premise that the FED will hold the interest rates steady and that the language of the policy statement will reflect a change in tone to a dovish stance which would further invigorate the market. Many are clamoring or worse, begging for a rate cut. Some have even gone as far as to predict that an interest rate cut will come as early as May. Because deep down at the core of the majority of the market's wishes is to keep the market rally going. No one wants the party to end. But sadly, like all good things, all things must have a beginning and an end.

The specter of recession looms large. We have seen the first early warning shots that our economy is not all right from the recent subprime melt down. Many would want the FED to step in, play the role of a good guy, and "save" the markets from the recent "turmoil". That would include a dovish statement from the FED, indication that tightening bias is done, and a wink and a nod that the rate cuts are near. That wishful thinking is erroneous.

First thing that everyone needs to understand is that the tightening bias of the FED that began June 2004 that brought the current rates up to 5.25% was implemented to ease the housing bubble that was looming large. The effect was to tighten the credit availability to cool the economy. The FOMC policy of easing interest rates to combat the post 2001 dot com era melt down was artificially engineered to prop up the economy and to induce stimulus to the economy. That stimulus then created the next bubble that is housing. One must seriously consider that the rate hike campaign was to take the excess that existed in the housing and credit markets. Now that the pin has began to prick the subprime excess, many are calling for the FED to stop that they have done enough. If Ben Bernake and Co at FOMC are true to the policies set forth by Alan Greenspan, then they must continue to maintain the tightening bias because we are not done with fighting inflation.

FOMC must battle still high inflation risk versus saving the equity and housing market. The US economy is widely believed to be slowing down to 2-3% growth for 2007 and 2008. I think that the economy is cooling as expected by the FOMC and these measured rate hikes are not to blame for the possible recession that may take place. The easy credit and the go-go housing boom is not fully contained. FOMC must consider that the subprime pruge has not yet ended and that ALT-A Option ARMS pose significant risks to the economy. The interest rate policy of FOMC must be focused and true to their intended purpose. That is to fight inflation and to keep US economy growing at a reasonable rate. If FOMC does not heed their original intended plan, and give into the whims of the market or for political aims, this economy will falter into possible stagflation. Stagflation can be characterized by the 1970's where inflation was sky high and US economic growth was nil. That is exactly what the FOMC statement tomorrow has the potential to avoid or create.

What must be done in this economic environment is to reduce the excess liquidity from easy credit and high inflation. To do that, the FED must do the right thing by acknowledging that the inflation remains critical concern of the FOMC and that further policy will be dependent on the core inflation rates. As our recent PPI and CPI indicates, we are not there yet. Job growth and unemployment is still robust enough for the FOMC to stay in a tightening bias. It may be short term pain for the US economy if the FED resumes tightening the interest rates, but the prospect of a recession versus stagflation, should have the FED doing the right thing. That is to continue to let excess out of the subprime and prime mortgage markets. Acknowledge that the mortgage sector is in need of serious reform, purge the subprime and prime slime that infects our economy. Mr. Bernake has the rare opportunity to do the right thing that may not be seen as being too popular but for the welfare of the future of our economy, he must stay vigilant about fighting inflation, now more than ever. Otherwise, sadly, Mr. Bernake may go the way of Mr. Greenspan, who will trade one boom for another, and cause instability and pain in the American economy.

Mr. Bernake, do the right thing. I know you can do it. The right thing is always the hardest. If you stand for what you truly believe as an accomplished academic, please do the right thing.

Monday, March 19, 2007

Other Blogs of Interest Regarding Countrywide Fraud

I typed in a google search for "Angelo Mozilo Fraud" and it returned some interesting blog sites and websites:

1)

http://blogs.denverpost.com/lewis/2007/03/11/mortgage-fraud-meltdown/

It continues to show that Countrywide is at the forefront of causing housing misery by originating large numbers of subprime loans.

2)

http://housingpanic.blogspot.com/search/label/mortgage%20fraud

Various stories and blogs on why we are in this subprime bubble and why it will spread to other sectors. Read this and be very scared. Again Countrywide is behind many of these "liar" loans.

3)

http://radar.planetizen.com/node/33862

Further issues with mortgage fraud elevating subprime loans by the mortgage brokers themselves.

4)

http://www.thefreelibrary.com/COALITION+AIMS+TO+STOP+HOME-APPRAISAL+FRAUD-a0140074739

is countrywide behind appraisal fraud as well. A story about how Countrywide has not spoken out against this rising issue. No comments from Countrywide when the reporter was seeking answers. Hmmm...

1)

http://blogs.denverpost.com/lewis/2007/03/11/mortgage-fraud-meltdown/

It continues to show that Countrywide is at the forefront of causing housing misery by originating large numbers of subprime loans.

2)

http://housingpanic.blogspot.com/search/label/mortgage%20fraud

Various stories and blogs on why we are in this subprime bubble and why it will spread to other sectors. Read this and be very scared. Again Countrywide is behind many of these "liar" loans.

3)

http://radar.planetizen.com/node/33862

Further issues with mortgage fraud elevating subprime loans by the mortgage brokers themselves.

4)

http://www.thefreelibrary.com/COALITION+AIMS+TO+STOP+HOME-APPRAISAL+FRAUD-a0140074739

is countrywide behind appraisal fraud as well. A story about how Countrywide has not spoken out against this rising issue. No comments from Countrywide when the reporter was seeking answers. Hmmm...

Doug Kass's Bracketology

SEC "Invites" Countrywide and Others for Investigation

"Broader Investigation of Lenders by SEC" was published today and written by Marcy Gordon, a business writer. Senator Dodd is spearheading this investigation. Senator Dodd is the chairman of the Senate Banking Comittee. My take on this investigation is that it will lead to further investigations and further insights into the problems inherent with the mortgage lending industry. One of the main purpose of this investigation is to see the extent to which the top 5 subprime mortgage lenders have engaged in "predatory" lending practices and to see the "factors" that contributed to this problem.

One of the interesting thing about this investigation, scheduled to take place on Thursday March 22, 2007, is that Countrywide Financial (CFC) has been named as one of top five originators of this loan. Others to be investigated include HSBC (HSBA), New Century (NEWC.PK), General Electric Co (GE), Washington Mutual (WM), and First Franklin Fiancial. All along, Countrywide (CFC) has been vehemently adamant about their subprime loan porfolio comprising only 7% of their entire loans originated. Yet, when the SEC is investigating the top 5 originators of this type of mortgage, Countrywide is at the forefront (CFC). Additionally, it is interesting to see such wide spectrum of unexpected players actually emerging as the top originators of subprime mortgage, namely, General Electric Co (GE). This is significant because the subprime issue is not only relegated to the subprime lenders but is inclusive of many companies that are not in theory or by testimony a subprime lender.

Countrywide (CFC) continues to lose credibility with me and quite possibly with the investment community. All along Countrywide (CFC) has affirmed that they are not a major player in subprime lending business. Isn't it ironic how they get invited as the top 5 subprime lenders in the country? Perhaps Countrywide is not being too truthful about this? This is not surprising based on their recent behavior from insider selling to massive PR efforts (think CNBC). I have written about the issues with Countrywide's Debt to Equity ratio as an a means to counter the relatively attractive PE ratios, PEG ratios, and Price to Sales ratio. And yet, when you dig deep into this company, just even a cursory look at the company's fundamentals will tell you that this company will soon head into trouble as long as they keep lying to the public about their situation.

One of the major issues to be considered at the SEC investigation on Thursday will be to see what extent these companies have acted in predatory fashion. Senator Dodd would be most interested in finding out how many poor, immigrants, and minorities comprised the entire loans originated from the beginning of the housing boom. Additionally, they will seek to gain knowledge on what actually precipitated the current subprime fiasco.

My thinking has always been that the companies that are most to blame are the publicly traded mortgage companies because of the pressure to show "growth" in revenues and EPS. Once the field got crowded and more "main stream" players such as Washington Mutual and Countrywide entered the fray, the pressure to originate subprime loans on riskier population took hold. From there, the "liar loans" or no-doc loans carrying low teaser rates were used to pad up earnings and Wall Street's favor. Once the game was apparent that it would end soon, many of these lenders resorted to hiding behing hiking dividends and increasing buy backs. CFC chose to go the way of buybacks and increased dividends. While these were attractive to the untrained eye, these buy backs were supported by additional debt. This should lead to two main question by the SEC. How much of the growth was garnered by creative accounting and how much loans originated broke fair lending practices? Moreover, hopefully, once the dust settles, it will be apparent that there will be two losers in this game. One is the subprime and prime ALT-A mortgage holders and the second is the retail investors who will be left holding the bag based on misinformation.

One needs to only look at today's Morning Star's Five Star Stocks. They named Countrywide (CFC) as such company. They believe that the PE valuation as well as PEG is reasonable and expect this "high quality" stock to survive the subprime melt down and sees this company as attractive for the long term. "Long Term" is an interesting term coined by Wall Street and its allied industry to screw hard working Americans to prop up the stock while the parties in the know can liquidate their shares. I also mentioned in yesterday's blog about the dangers of following PE and PEG ratio as a measure of "value" in companies wihtout considering the DEBT TO EQUITY ratio.

What matters most is that Countrywide has been named as a participant on SEC's investigation. I don't know how much truth will be revealed under oath. Will CFC finally face the music and confess that all is not well in the mortgage industry, and, especially in the interest of all that is good (or that is left that is good in this world) prevent further deterioration of shareholder value at the price of insider greed. I doubt it. I am sure that they will deny that anything is really wrong. I doubt it because while they are screwing the shareholders of wealth, they are getting rich. There is nothing that a well crafted defined benefits plan or children's trusts or Limited Partnerships that can save the souls of these people whose main purpose is greed. But like all things, things will end in tears, with half assed apologies in front of juries that will pass judgement, and the shareholders will be the only ones who will truly get hurt because of CFC's arrogance.

One of the interesting thing about this investigation, scheduled to take place on Thursday March 22, 2007, is that Countrywide Financial (CFC) has been named as one of top five originators of this loan. Others to be investigated include HSBC (HSBA), New Century (NEWC.PK), General Electric Co (GE), Washington Mutual (WM), and First Franklin Fiancial. All along, Countrywide (CFC) has been vehemently adamant about their subprime loan porfolio comprising only 7% of their entire loans originated. Yet, when the SEC is investigating the top 5 originators of this type of mortgage, Countrywide is at the forefront (CFC). Additionally, it is interesting to see such wide spectrum of unexpected players actually emerging as the top originators of subprime mortgage, namely, General Electric Co (GE). This is significant because the subprime issue is not only relegated to the subprime lenders but is inclusive of many companies that are not in theory or by testimony a subprime lender.

Countrywide (CFC) continues to lose credibility with me and quite possibly with the investment community. All along Countrywide (CFC) has affirmed that they are not a major player in subprime lending business. Isn't it ironic how they get invited as the top 5 subprime lenders in the country? Perhaps Countrywide is not being too truthful about this? This is not surprising based on their recent behavior from insider selling to massive PR efforts (think CNBC). I have written about the issues with Countrywide's Debt to Equity ratio as an a means to counter the relatively attractive PE ratios, PEG ratios, and Price to Sales ratio. And yet, when you dig deep into this company, just even a cursory look at the company's fundamentals will tell you that this company will soon head into trouble as long as they keep lying to the public about their situation.

One of the major issues to be considered at the SEC investigation on Thursday will be to see what extent these companies have acted in predatory fashion. Senator Dodd would be most interested in finding out how many poor, immigrants, and minorities comprised the entire loans originated from the beginning of the housing boom. Additionally, they will seek to gain knowledge on what actually precipitated the current subprime fiasco.

My thinking has always been that the companies that are most to blame are the publicly traded mortgage companies because of the pressure to show "growth" in revenues and EPS. Once the field got crowded and more "main stream" players such as Washington Mutual and Countrywide entered the fray, the pressure to originate subprime loans on riskier population took hold. From there, the "liar loans" or no-doc loans carrying low teaser rates were used to pad up earnings and Wall Street's favor. Once the game was apparent that it would end soon, many of these lenders resorted to hiding behing hiking dividends and increasing buy backs. CFC chose to go the way of buybacks and increased dividends. While these were attractive to the untrained eye, these buy backs were supported by additional debt. This should lead to two main question by the SEC. How much of the growth was garnered by creative accounting and how much loans originated broke fair lending practices? Moreover, hopefully, once the dust settles, it will be apparent that there will be two losers in this game. One is the subprime and prime ALT-A mortgage holders and the second is the retail investors who will be left holding the bag based on misinformation.

One needs to only look at today's Morning Star's Five Star Stocks. They named Countrywide (CFC) as such company. They believe that the PE valuation as well as PEG is reasonable and expect this "high quality" stock to survive the subprime melt down and sees this company as attractive for the long term. "Long Term" is an interesting term coined by Wall Street and its allied industry to screw hard working Americans to prop up the stock while the parties in the know can liquidate their shares. I also mentioned in yesterday's blog about the dangers of following PE and PEG ratio as a measure of "value" in companies wihtout considering the DEBT TO EQUITY ratio.

What matters most is that Countrywide has been named as a participant on SEC's investigation. I don't know how much truth will be revealed under oath. Will CFC finally face the music and confess that all is not well in the mortgage industry, and, especially in the interest of all that is good (or that is left that is good in this world) prevent further deterioration of shareholder value at the price of insider greed. I doubt it. I am sure that they will deny that anything is really wrong. I doubt it because while they are screwing the shareholders of wealth, they are getting rich. There is nothing that a well crafted defined benefits plan or children's trusts or Limited Partnerships that can save the souls of these people whose main purpose is greed. But like all things, things will end in tears, with half assed apologies in front of juries that will pass judgement, and the shareholders will be the only ones who will truly get hurt because of CFC's arrogance.

Low Volume Bounce Does Not A Bull Market Make.

Today's action was impressive. But like all rally attempts lately, it was on weak volume. The Nasdaq finished up $21.75 on below average 17,033,400 volume. The S&P 500 gained 1.1% up $15.11 on below average volume of 14,606,600. The volume was weak across other major indices. This is typical of the type of bounces in the market after a down week in a newly established bear phase market. It would be too premature until the market confirms the new uptrend on strong volume and one of the major averages advancing more than 1.5%. So far that has not materialized. These types of bounces have trapped many bulls lately and the best course of action in these environment is in cash, as I have harped on this issue countlessly before. Or, if you are adventuresome, you can go short or trade the volatility on both the long and short side (not recommended), but certainly opportunities exists.

Having said that, I do not see any reason to believe that the markets are healthy or that even a bottom has been reached. Historically speaking the bottom may not even be formed until at least 5 to 6 weeks into the correction. I do not think it will happen that soon. The 400+ point drop few weeks back has severely damaged the technical conditions of our market. Technical analysis is akin to psychology trading and much psychological damage amongst investors have been done. It will take time to heal these wounds. Once time heals the wounds, I may consider going long, but for now, I will stay with the trend.

Economic developments today gave a bounce today across the markets. At least for a day, we put some of the subprime worries in the back burner. But be aware, do not discount the subprime issues. Mega merger news across the globe gave this beaten down market a much needed bounce. I am now slowly keeping an eye on the follow through of this market and see if this market can regain the uptrend. Many of the prior leaders today have regained their 50 EDMA or is close to it. Still many others are stagnating and are churning. More on that as things develop. The last thing that I want to do is to get caught with my shorts down when the market turns, which can be sudden. But again, I do not think we are there yet.

NYSE has recored record margin levels since 2000. Subprime investigation by SEC is widening. ALT-A Loan chatter is growing. China just riased interest rates by 27 basis points. Wall street is bracing for corporate earnings slow down. Automobile industry (domestic) is in shambles. Inflationary pressure appears to be rising. Japanese carry trade is dwindling.

All of these chatter represent the prescient issues associated with our market today. Tomorrow, FOMC meeting will be held to decide on the monetary policy. I do not anticipate any action but it is their wording that will matter tomorrow. The FED must contend with growing chatter of subprime issues sending our economy into a recession versus fighting inflation. I don't think the FED is in a good position because anything that they do will likely harm this economy. Choose your poision.

Having said that, I do not see any reason to believe that the markets are healthy or that even a bottom has been reached. Historically speaking the bottom may not even be formed until at least 5 to 6 weeks into the correction. I do not think it will happen that soon. The 400+ point drop few weeks back has severely damaged the technical conditions of our market. Technical analysis is akin to psychology trading and much psychological damage amongst investors have been done. It will take time to heal these wounds. Once time heals the wounds, I may consider going long, but for now, I will stay with the trend.

Economic developments today gave a bounce today across the markets. At least for a day, we put some of the subprime worries in the back burner. But be aware, do not discount the subprime issues. Mega merger news across the globe gave this beaten down market a much needed bounce. I am now slowly keeping an eye on the follow through of this market and see if this market can regain the uptrend. Many of the prior leaders today have regained their 50 EDMA or is close to it. Still many others are stagnating and are churning. More on that as things develop. The last thing that I want to do is to get caught with my shorts down when the market turns, which can be sudden. But again, I do not think we are there yet.

NYSE has recored record margin levels since 2000. Subprime investigation by SEC is widening. ALT-A Loan chatter is growing. China just riased interest rates by 27 basis points. Wall street is bracing for corporate earnings slow down. Automobile industry (domestic) is in shambles. Inflationary pressure appears to be rising. Japanese carry trade is dwindling.