Today was a broad rally, spurred by the FED comments and their decision to leave the interest rates unchanged. This interest rate policy was widely anticipated. What is perplexing about this rally is that the FED comments were not at all dovish. Because the FED changed the sentence and word structure of their policy statement, the market perceived this as an end to rate hikes. But when you read the statement without trying to find the implicit or explicit meanings the FED is still concerned about the high inflation and that the housing issue is an ongoing issue. There was no where in the statement that would be even suggestive of the fact that the FED is considering cutting rates or that they will even consider that. All we know is that the inflation is acknowledged as being above their comfort level and that they will continue to be vigilant in combating inflation.

Please see this site as this breaks down and compares the FED policy statemetns:

http://calculatedrisk.blogspot.com/2007/03/fed-weaker-economy-more-inflation.html

Additionally, while technically, today can be consider the "follow" through day, I believe it is a bit early in the correction cycle to have much validity. Usually, according to IBD, a follow through that has the highest rate of success the one that occurrs after at least 7 weeks of correction cycle. Additionally, the follow through day is defined as a bullish movement in one of the major indices on strong volume of at least 1.7% on the fourth day to the 7th day, after the first attempted rally. Additionally, all bullish uptrend started with a follow through day but not all follow through day leads to a bullish uptrend. This bullish movement began last Thursday which counted as day 1 and today's follow through was day 5 of that attempted rally. Today's breadth was strong. 9:1 ratio of advancers to decliners put an exclamation point to today's follow through. It has been mentioned that a day like today where the advancers trumped decliners, especially on a follow through day means that the bullish movement is especially strong. That is true whenc onsidering historically when the follow through day had such incredible breadth.

But an article on today's Barron's Online syndicated article Getting Technical "Is It Morning in the Stock Market?", he has presented an interesting view that perhaps this is the volatility inherent within the bear phase market that has left both the bulls and bears running for cover. He point out that on March 7 Getting Technical showed that the chart pattern exhibited at that time resembled the chart pattern from 1994 and 1999 peaks which lead to a trap after breaking above the trading range, which eerily similar to today's situation.

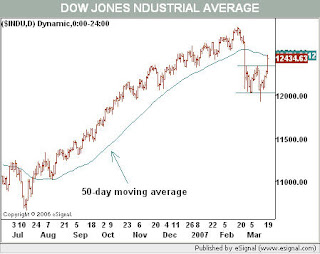

He also points out that on March 14th, when the Dow fell more than 136 points intraday and breaking support underneath the 12,000 level, the bears seemed to have the upper hand only to reverse above the support level causing a bear trap. Thus when looking at the chart shown below, you will see that this pattern shown both today's bullish follow through and the bearish breakdown on March 14th, some concerns. Notice the extreme ranges on the chart breaking through the support and resistance parallel lines?

He also points out that on March 14th, when the Dow fell more than 136 points intraday and breaking support underneath the 12,000 level, the bears seemed to have the upper hand only to reverse above the support level causing a bear trap. Thus when looking at the chart shown below, you will see that this pattern shown both today's bullish follow through and the bearish breakdown on March 14th, some concerns. Notice the extreme ranges on the chart breaking through the support and resistance parallel lines?I am not trying to discredit today's follow through. I just want the readers to acknowledge the fact that not all follow throughs lead to bullish uptrend. We are still in a technically broken market and any bullish complacency that might drift into the market, it may be met with unexpected whip saw that will have the bulls scurrying for the exits. Too many economical issues both macro and micro, exists to be comfortable in this environment. Additionally, this rally seemed to have been fueled by desperate short covering which exaggerated the movement today. But it is also true that no rally ever started with out the "short squeeze".

We will see tomorrow what the fate holds for the market. But for now, the best place to be in is cash. In a bear phase extremes in volatility exists and just when you get comfortable, the old man market casts a nasty dose of whipsaw.

I will be watching with great enthusiasm what might unfold tomorrow when Senator Dodd investigates the subprime mortgage leaders on what might have gone wrong. I still remain very skepticle about Countrywide and their insider selling issues and whether they will be as strong as they say they will be once the dust settles from the subprime fall out. I am leary of the fact that Mr. Mozilo did not personally attend to discuss this important issue and clear his company's name, granted it is not a trial, but there is so much chatter about this company, you would think that if he had nothing to hide, he would jump at the opportunity to clear his company and his name.

On several fronts, Apple seems to have the momentum to the upside and many prior leaders such as Google, BIDU, ISRG have gained a solid footing today. We will see if that continues. BIDU also has broken the $100 mark in convincing fashion today. Barring a bearish reversal, I believe that this company has possibly began the move to the upside. We will see.

As for Countrywide (CFC), I remain short term, intermediate term, and long term bearish. I am awaiting the next shoe to drop for this company. I also read an interesting article today on Dow News Wire that questioned formally Mr. Mozilo's increased firesale activity. This story keeps getting better and better. I remain short in this stock, though I took a big hit today, I am not rattled. It has become a cause for me to keep digging.

You can read Michael Kahn's article on his syndicated column Getting Technical on Barron's Online.

Please stay safe and go to cash in these uncertain times. It is not what it seems.

1 comment:

I remain short in CFC as well.

Post a Comment